The Cost of Business Insurance in Illinois

The price of business insurance premiums can vary significantly from one company to the next. This is because rates are calculated according to a wide variety of factors such as your business’s liability risks, the value of your commercial assets, the number of people you employ, and the type of industry you operate in. There are several different insurance types and options that you can choose from as you customize your commercial insurance policy package. A local independent agent can help you find the coverage you need at the most competitive rate.

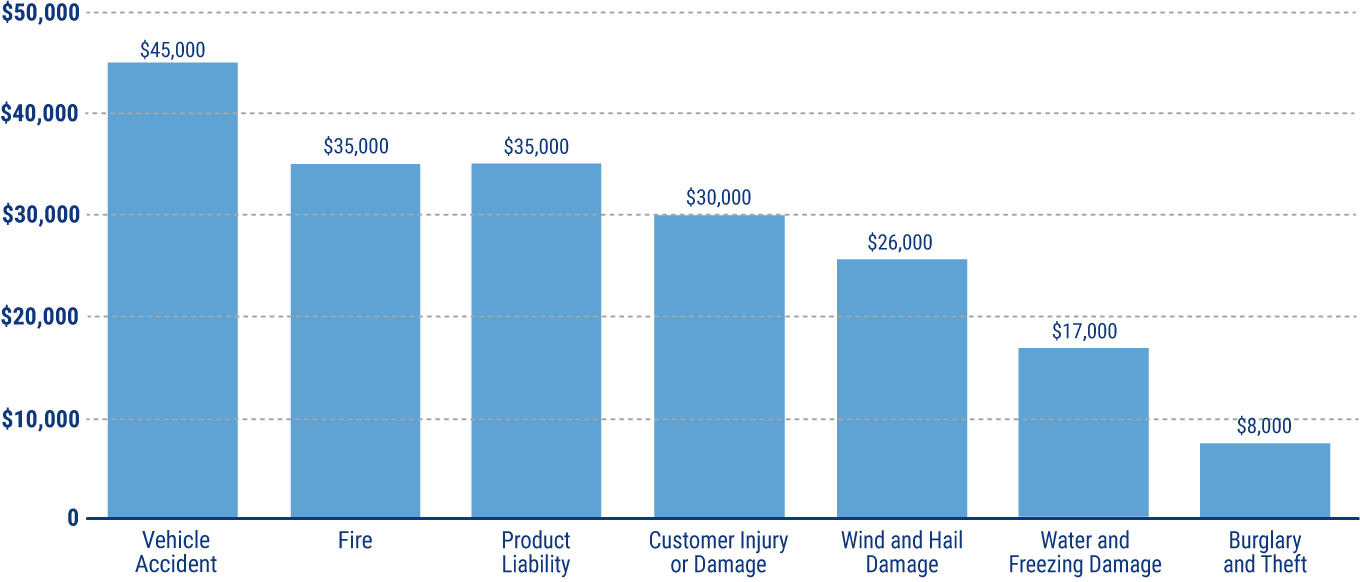

Average Cost for the Top Business Insurance Claims in Illinois