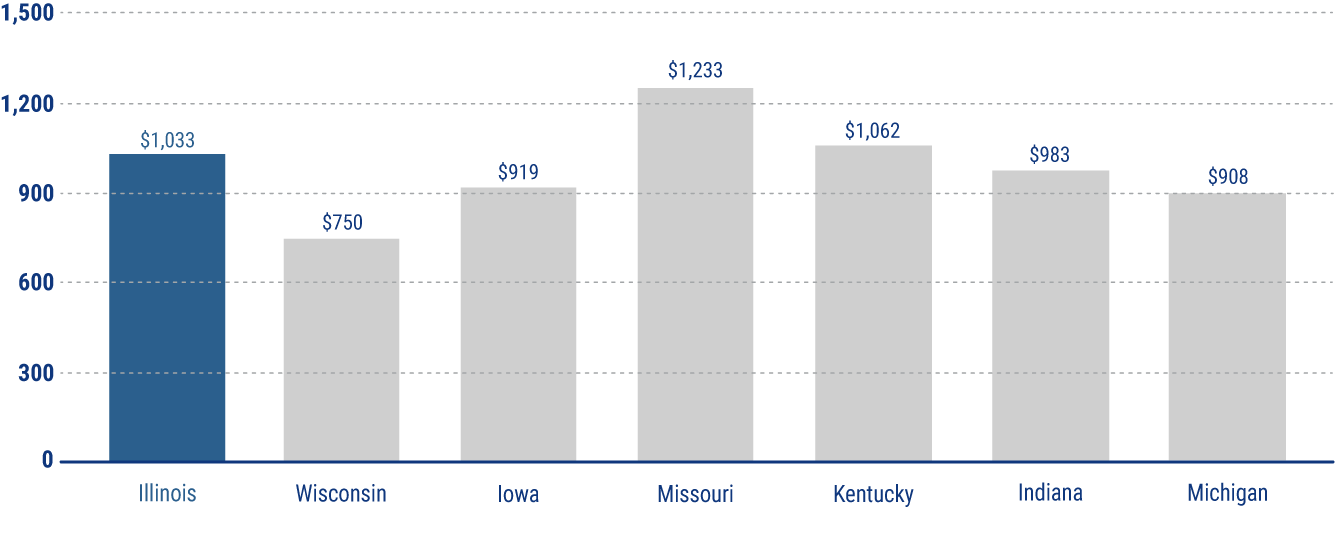

What is the Average Cost of Homeowners Insurance in Illinois?

The average cost of home insurance in Illinois is $1,033 a year. This is lower than the national average rate of $1,173. Premiums are calculated on a case-by-case basis according to several factors such as the size, age, and value of your house, how many stories your house has, whether your house includes a basement, the weather risks and crime rate in your ZIP code, your claims history, and even your credit score. Every insurance company has a different method for calculating rates, so comparing quotes is a good way to make sure you are getting your policy at a competitive price.

Average Price of Homeowners Insurance around Illinois