Hurricanes don't tend to make landfall in Illinois, but the state still feels the devastating remnants of tropical storms. Once your home and belongings are ruined by flood damage, it's too late to purchase insurance.

That's why you want to have flood insurance long before a hurricane occurs. Working with an Illinois independent insurance agent, you can buy flood insurance before a storm hits.

Can I Buy Flood Insurance before a Hurricane in Illinois?

Flood insurance is a type of federal insurance option that is offered through the National Flood Insurance Program (NFIP). You can purchase flood insurance at any time, but there are some restrictions.

"Timing matters when purchasing flood insurance," explained insurance expert Paul Martin. "If a hurricane is expected to hit the state and you don't already have coverage, you'll be denied. Your policy must be purchased at least 30 days prior to a storm in order to be covered for damages."

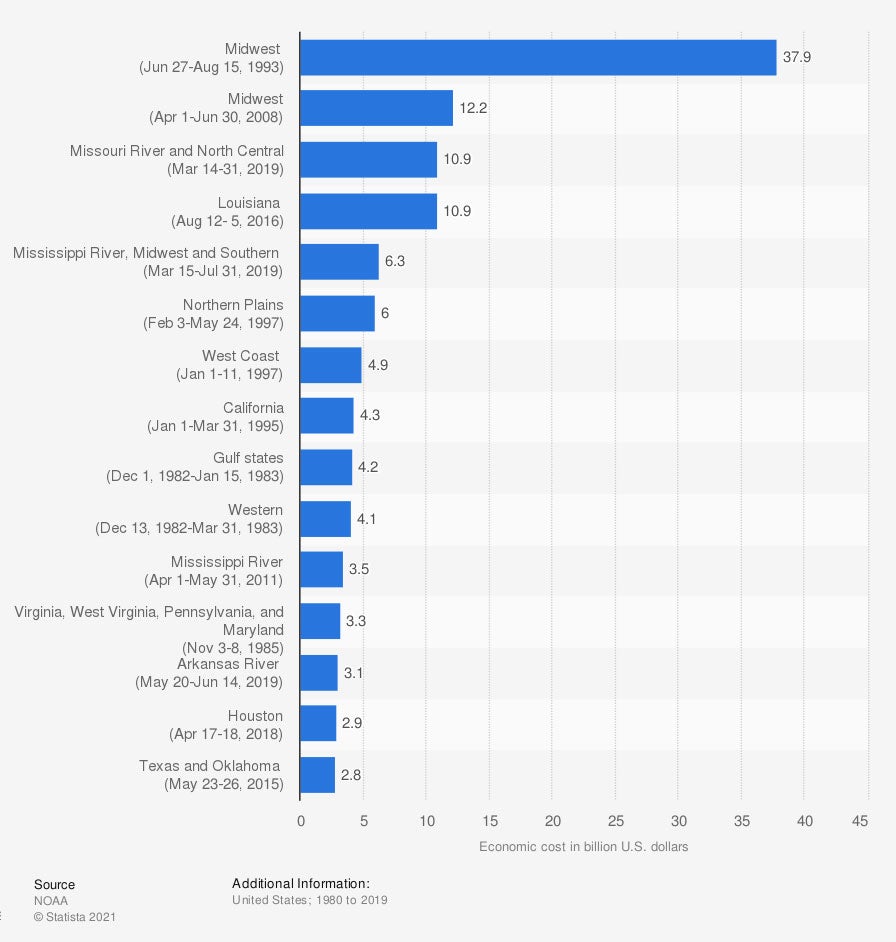

Major flooding events in the US, by economic cost

The Midwest has experienced the most financially devastating floods in the history of catastrophic events in the US.

Where Can I Buy Flood Insurance In Illinois?

Flood insurance can be purchased through the NFIP program offered by FEMA. An Illinois independent insurance agent will be familiar with the program and the insurance carriers that it partners with in the state.

Through the NFIP program, you can purchase up to $250,000 in building coverage and $100,000 in contents coverage to protect your home and belongings. If you need additional coverage amounts, you can purchase excess flood coverage through private insurers.

Does Flood Insurance Cover a Hurricane?

The NFIP considers an event a flood when natural waters result in coverage of more than two acres of typically dry land or inundation of two properties. Rainwaters that accumulate from a hurricane are considered natural waters, and are therefore covered under flood insurance.

Flood insurance will also cover damage from natural waters from events such as:

- Thunderstorms

- Hail

- Overflow of rivers, lakes, and streams

- Dam breaks

- Broken levees

- Outdated drainage systems

Whether you're in a low or high-risk area, working with an Illinois independent insurance agent can make sure you're properly protected.

Why Do I Need Flood Insurance In Illinois?

Floods account for more than 90% of the declared disasters in Illinois. With a large variety of rivers, streams, and lakes, much of the state is at risk of flooding.

Illinois flood and disaster stats

- 7,400 square miles are subject to flooding

- 25 billion gallons flow in streams every day

- 250,000 buildings are located in floodplains

- 706 flood insurance claims are made each year

- $700 million in flood damage every year

How Long in Advance Do You Need to Have Hurricane Insurance?

If you're purchasing flood insurance from the NFIP, then your policy must be in place at least 30 days prior to a hurricane.

Should your home or belongings be damaged by a hurricane and you don't have an effective policy, then you would be financially responsible for the losses.

Not every county in Illinois participates in the National Flood Insurance Program. Currently, 82 counties and 770 communities in Illinois participate, which is why it's important to speak with your Illinois independent insurance agent to learn about your options for coverage.

How Can an Independent Insurance Agent Help You?

Hurricanes cause billions of dollars in damage to properties and possessions. Having the proper flood insurance is crucial, but it's not as simple as calling your local insurance carrier.

An Illinois independent insurance agent understands flood insurance and the options available for Illinois homeowners. They'll chat with you, free of charge, to learn your needs and assist you in buying flood insurance before any events affect your home.

Author | Sara East

Article Reviewed by | Paul Martin

Flood stats: https://www2.illinois.gov/dnr/WaterResources/Pages/nfip.aspx

https://www.floodsmart.gov/

Flood insurance GEO data

© 2025, Consumer Agent Portal, LLC. All rights reserved.