Quick Content Navigation

- What Is Storm Insurance?

- What Does Storm Insurance Cover in Illinois?

- What Does Storm Insurance Not Cover in Illinois?

- Does Car Insurance Cover Storm Damage in Illinois?

- Common Insurance Claims for Storm Damage

- How to File a Claim for Storm Damage in Illinois

- How an Illinois Independent Insurance Agent Can Help You

What Is Storm Insurance?

Storm insurance in Illinois typically doesn't come in a separate policy, but it can. It will depend on what type of storm coverage you need and where you live most of the time. To obtain the right protection, take a look at what's covered under storm insurance.

- Storm insurance: This type of property insurance covers a structure, vehicle, or other property for damage resulting from a storm. This is caused by hail, flooding, tornadoes, hurricanes, and other severe weather losses.

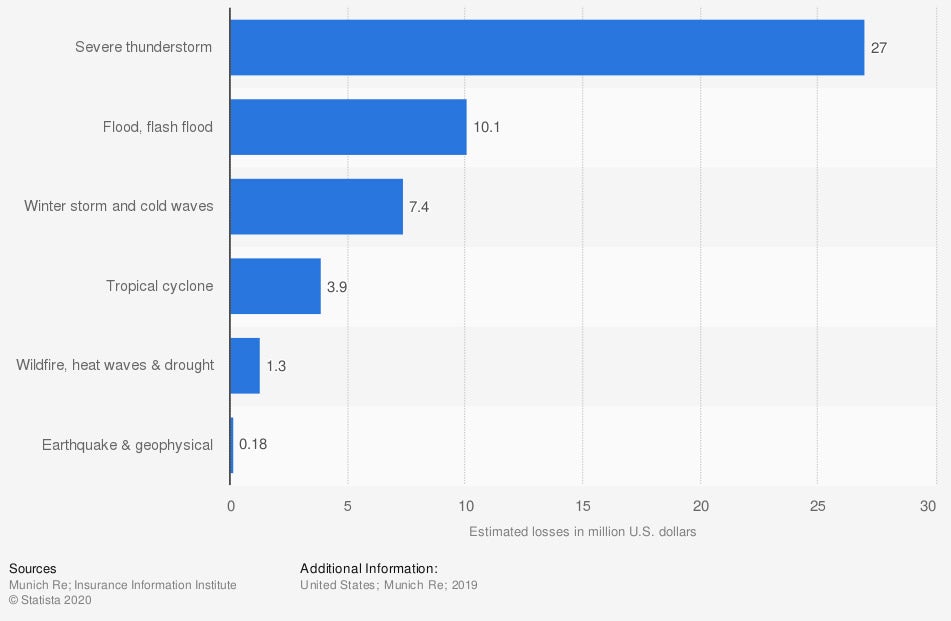

Losses in the US by Natural Disaster Type

Fortunately, most of your primary policies will include coverage for storms or give you the option to add it. When it comes to your auto policy, review your insurance for sufficiency.

What Does Storm Insurance Cover in Illinois?

Damage from a storm can be extensive. It could completely total your car, leaving you without a vehicle to drive. The necessary coverage should be taken into account when shopping for solutions. Check out what storm insurance can cover in Illinois.

- Personal belongings

- Structures

- Vehicles

Coverage will take your property back up to like, kind, and quality. The insurance companies will replace or repair your items so they are restored back to their original state prior to the loss.

What Does Storm Insurance Not Cover in Illinois?

Your Illinois auto, home, or commercial policies will have exclusions. Whether your property has coverage for a storm loss or not will depend on the type of storm and what the damage was. In most cases, you will have to get a separate flood insurance policy if there was flood damage. When hail occurs, your policies may automatically include property coverage. Each claim and policy will have something different to say about storm coverage, so it's best to check with a licensed professional on your insurance specifics.

Does Car Insurance Cover Storm Damage in Illinois?

When it comes to your auto insurance in Illinois, storm damage is not automatically covered. While your home and other property policies will have storm coverage included, a separate policy for your auto has to be added. It's known as comprehensive insurance and is a limit that can be endorsed per vehicle on your policy. A deductible of usually $500 to $1,000 will apply when a loss if filed. It includes protection for your vehicles and other property within your autos resulting from a storm claim.

Common Insurance Claims for Storm Damage

Storm damage can come in many forms. Illinois has many different type of severe weather that could damage your vehicles which is why having the right policy limits is so important when obtaining coverage. Comprehensive and collision insurance can help you save a significant out-of-pocket expense. Take a look at the facts.

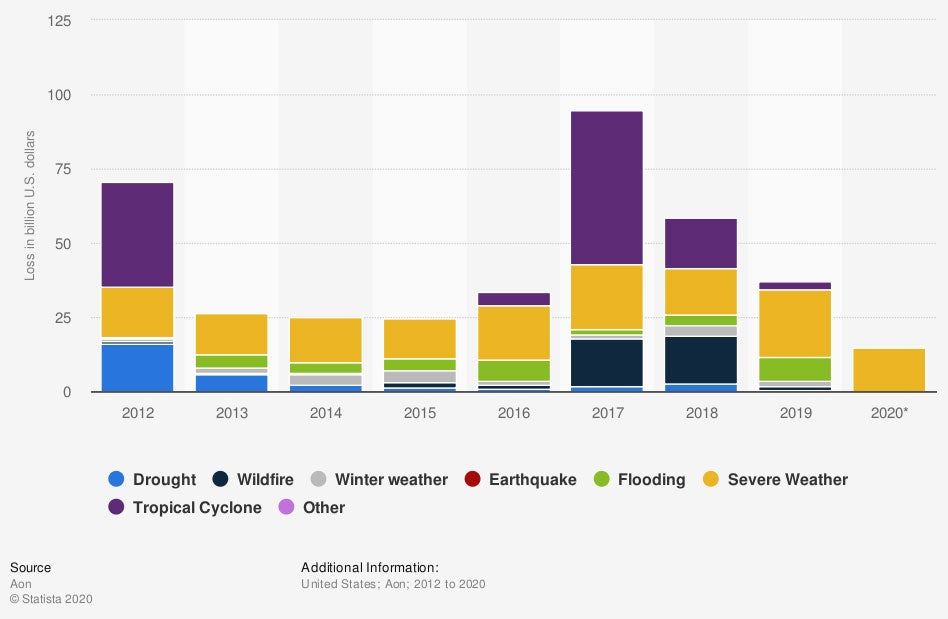

US Natural Disaster Losses by Type

You can see from the graph that there are several kinds of disasters that could affect your property. The best way to have enough protection is by reviewing your policies with a licensed adviser before it's too late.

How to File a Claim for Storm Damage in Illinois

When there is storm damage to your car in Illinois, it's essential to have an action plan before a loss occurs. If you are victim of severe weather, you could be in a state of shock and not know what to do next. Here are four simple steps to follow when filing a storm damage claim.

- Step 1: Get to a safe place

- Step 2: Call your independent insurance agent immediately

- Step 3: Obtain a replacement vehicle paid for by your insurance company

- Step 4: Set up a meeting with your assigned adjuster to go over damage details

How an Illinois Independent Insurance Agent Can Help You

If you're searching for an Illinois auto insurance policy, consider using a trained professional. Coverage can be tricky when you're unsure what's necessary for adequate protection. There are many policy options to choose from and every insured needs something different.

Fortunately, an Illinois independent insurance agent can help find coverage for an affordable price. Since they work with several carriers at once, you can save time and money. Get connected with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/612615/value-of-insured-losses-usa-by-natural-disaster-type/

Graphic #2: https://www.statista.com/statistics/216836/estimated-overall-losses-due-to-natural-disasters-in-the-united-states/

http://www.city-data.com/city/Illinois.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.