Quick Content Navigation

- What Does Crop Insurance Cover in Illinois?

- What Doesn't Crop Insurance Cover in Illinois?

- What Is Considered a Flood in Illinois?

- What Are Flood Zones in Illinois?

- What Does Flood Insurance Cover in Illinois?

- What Doesn't Flood Insurance Cover in Illinois?

- How an Illinois Independent Insurance Agent Can Help You

What Does Crop Insurance Cover in Illinois?

Insuring your farm is one thing, but what about coverage for your crops? Your crop insurance policy is usually separate from your overall farm insurance, but is sometimes included on your main policies. Multiple peril crop insurance will provide coverage against several losses for your crops. Take a look at what it covers in Illinois:

Multiple peril crop insurance (MPCI) protects against:

- Severe weather

- Crop disease

- Drought

- Fire

- Insect damage

- Flooding

- Low yields

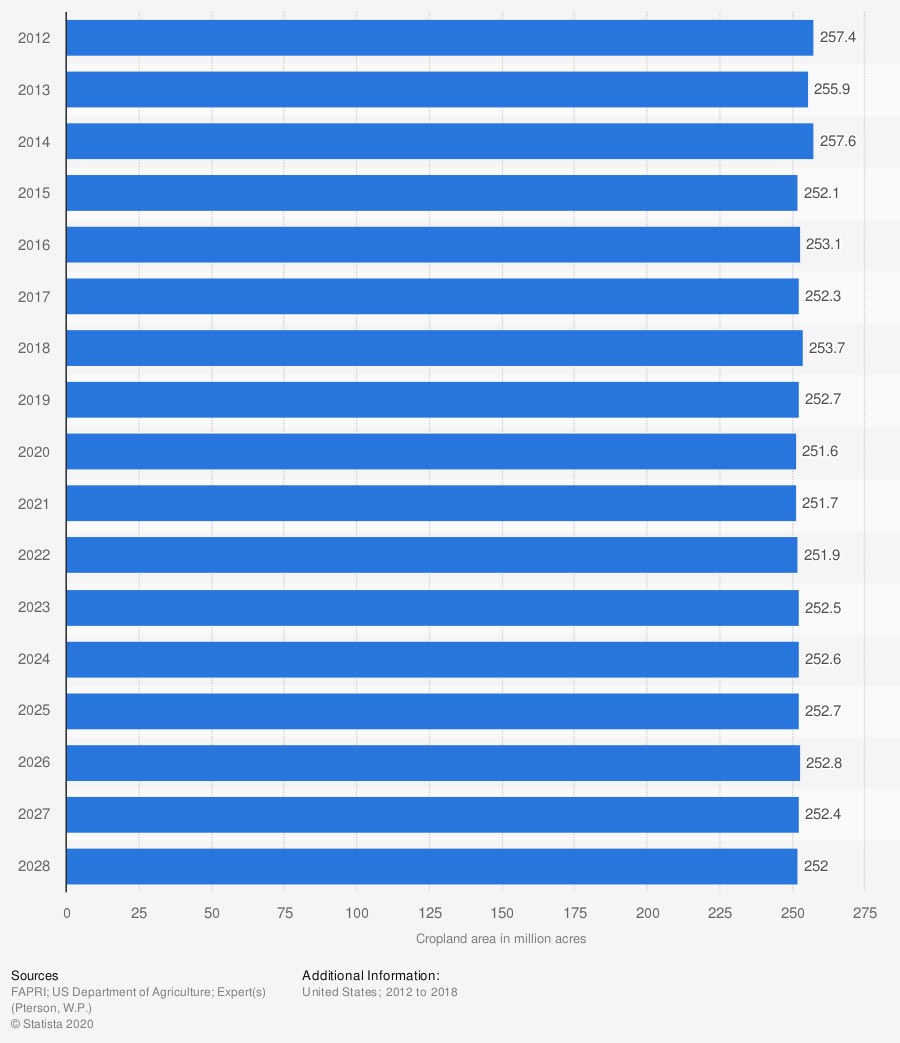

Total US Cropland (in million acres)

A lot of acres are used for crops and agriculture in the US. If your Illinois farm produces crops for distribution, the right policy is needed.

What Doesn't Crop Insurance Cover in Illinois?

It's important to understand what your crop insurance won't cover. Like your other commercial insurance policies, there are exclusions. Check out what's not included in your standard crop insurance, but can usually be added:

- Hail damage: This is a separate policy known as crop-hail insurance that can be purchased to cover hail damage.

- Revenue: If you have a low-yielding year, your basic crop policy might have some coverage, but you might also need crop revenue insurance to keep you afloat.

What Is Considered a Flood in Illinois?

When it comes to insuring your farm, there are a lot of exposures that could wreak havoc on your operation. When you're dealing with crops, you'll want coverage for flooding. First, you need to understand what's considered a flood in Illinois:

- What is regarded as a flood: A flood is an excess of water on land that is usually dry. This typically is classified as affecting two or more acres of land or two or more properties.

What Are Flood Zones in Illinois?

Flood zones are assigned to every location. When you own a farm with crops, it's crucial to understand the risk of having a flood. Take a look at the difference between flood zone types in Illinois:

- Flood Zones B, C, and X: These are areas with low-to-moderate flood risk, and annual premium for flood policy is usually lower. Also, flood insurance is typically not a requirement by your lender for this zone type.

- Flood Zones A and V: These are areas with high flood risk, and the most significant chances of flood losses. Your premiums will be more expensive, and lenders will require flood insurance.

What Does Flood Insurance Cover in Illinois?

Floods occur in most every state in the US. If you own a farm that produces crops in Illinois, you'll want the necessary flood protection for your products. Take a look at what your Illinois farm flood policy will cover:

- Replacement of the crops

- Repair to the area

- Loss of farm income

- Dwelling and barn repair/ replacement

Your crop policy will usually have flood coverage, and you can add a separate flood insurance policy for your farm in general. Speak with a trusted adviser on different variations of flood insurance.

What Doesn't Flood Insurance Cover in Illinois?

Flood insurance can be a separate policy for your crops, depending on your carrier. Most of the time it will be included under your multiple peril crop insurance, but it will still have exclusions that apply.

Losses that are generally excluded from your flood policy:

- Water/sewer back-up

- Burst pipes

- Waterline malfunctions

- Water leaks

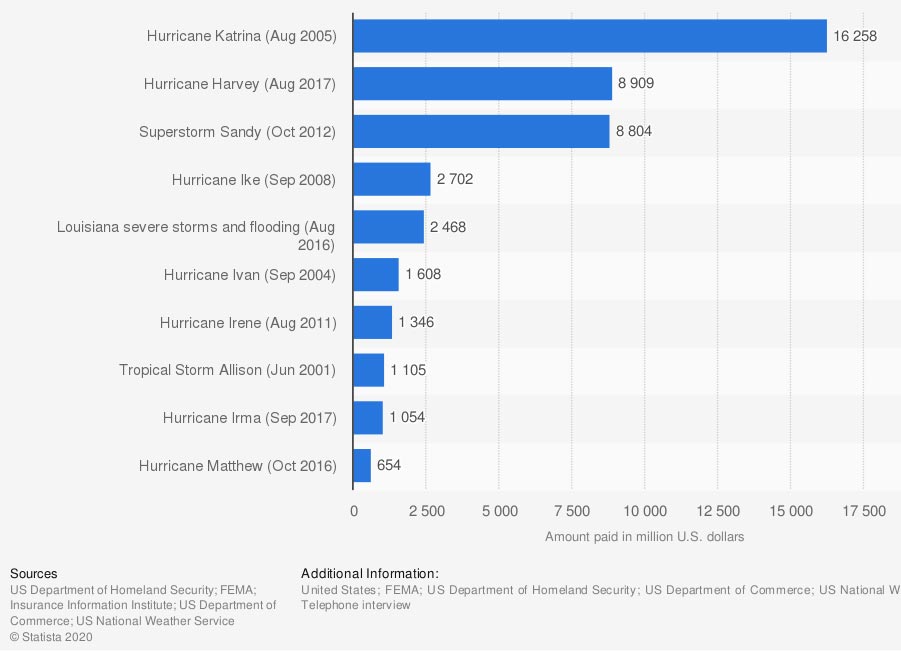

Most expensive flood disasters in the US (in million US dollars)

Floods occur every year and should be insured adequately. If you're without proper coverage, you could have to pay thousands of dollars out of pocket.

How an Illinois Independent Insurance Agent Can Help You

If you're searching for the best Illinois crop coverage, then you'll want a policy that protects against flooding. Your product is your livelihood and should be insured for damage. Instead of going it alone, consider using a trained professional.

An Illinois independent insurance agent can help with coverage and premium options that won't break the bank. They do the shopping for you at no additional cost to your farm. Get connected with a local expert on TrustedChoice for custom quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic # 1: https://www.statista.com/statistics/201762/projection-for-total-us-cropland-area-from-2010/

Graphic # 2: https://www.statista.com/statistics/216501/most-expensive-us-flood-disasters/

http://www.city-data.com/city/Illinois.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.