An electrical fire in your brand-new Illinois home is costly and disappointing. When you buy a new home, you expect everything to be in tip-top shape. So if an electrical fire happens right after you move in, is it your fault or the fault of the contractor who built your home?

An Illinois independent insurance agent can answer this question and provide insight into the coverage you have in your home insurance against electrical fires. Home electrical fires account for an estimated 51,000 fires each year, so understanding your coverages can help you recover from an unexpected event.

Who’s Responsible If There’s an Electrical Fire in My New House?

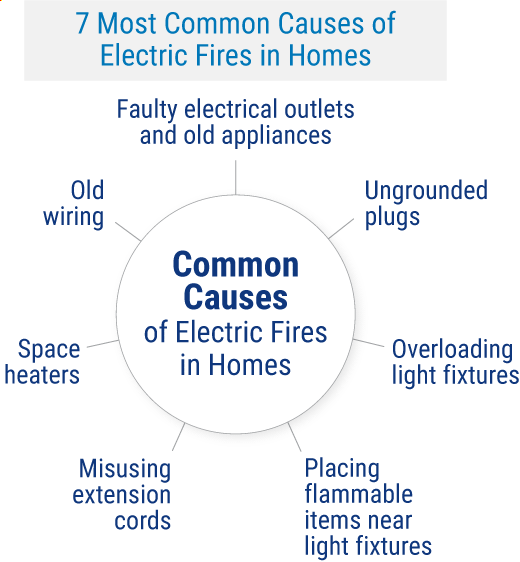

Electrical fires can start from a variety of situations, and they cause around $1.3 billion in property damage every year.

Even if your home is brand-new, as the person occupying the home, you'd be responsible for the electrical fire, unless you can prove that the builder or contractor was at fault.

Either way, you would start the process by filing a claim with your home insurance. The insurance company will investigate the claim. They may deny the claim if the fire is the result of faulty workmanship by the builder.

What If the Builder Won’t Claim Responsibility?

If you're certain that the builder is responsible and they're refusing to pay for the damage, you could take legal action against them. In this case, you'd likely be paying for any fees associated with the lawsuit out of pocket.

You also have the option of filling a claim against the builder's business insurance. Before you take any actions against a business, it's best to seek the advice of your independent insurance agent and an attorney. This way you know your rights before getting into a messy legal battle.

Am I Responsible for Covering Any Damage Caused by the Electrical Fire?

When you file a home insurance claim for an electrical fire, you are covered up to your policy limits under your structural and contents coverage. Any expenses beyond this would have to be paid out of pocket.

Home insurance also provides coverage for temporary housing and even liability lawsuits if you were to get sued. You are always responsible for your policy deductible before your insurance will pay out any claims.

How Costly Are Electrical Fires in the Home?

As a homeowner, it's common to hear about accidental water damage, flooding and fires. But electrical fires are more common than you may realize. Just check out these stats.

- Home electrical fires account for nearly 500 deaths a year.

- More than 1,400 injuries a year are related to home electrical fires.

- Electrical distribution systems are the third leading cause of structure fires in the home.

- 65% of home fire deaths are the result of fires in homes without working smoke detectors.

What Does Homeowners Insurance Cover in Illinois?

Homeowners insurance in Illinois protects your home, the family inside it, and your stuff from a number of perils that are listed in your policy. These perils include:

- Fire or lightning

- Windstorm or hail

- Explosions

- Riots or civil commotion

- Damage caused by aircraft

- Damage caused by vehicles

- Smoke

- Vandalism or malicious mischief

- Theft

- Volcanic eruption

- Falling objects

- Weight of ice, snow or sleet

- Specific accidental water damage for certain systems and appliances

- Freezing of certain plumbing, heating and air systems, and other systems

Through four essential policies, home insurance covers events related to these perils.

- Structural damage: Covers damage or destruction to the home's structure, including built-in appliances and garages, and extends to sheds and similar structures.

- Personal property damage: Covers damage or destruction to personal belongings such as electronics, furniture, collectibles, kitchen items, and other valuables.

- Liability: Covers any legal fees or medical bills if you're sued for an injury or property damage.

- Additional living expenses: Covers daily bills, including hotel stays, meals, pet boarding, and gas mileage, if you need to leave your home while repairs are being made after an electrical fire.

What Doesn't Homeowners Insurance Cover in Illinois?

Understanding what's not covered by home insurance is equally as important as knowing what is covered by your policy. Home insurance is customizable and comprehensive, but a few things are not covered.

- Routine maintenance fees

- Lack of upkeep by the homeowner

- War/nuclear fallout damage

- Business-related liability issues

- Insect damage

- Flood or earthquake damage

Some of these exclusions can be covered through add-on policies. An agent can help you get additional coverage where you need it. In Illinois, you may want to consider adding a separate flood insurance policy to protect your home.

How Can an Illinois Independent Insurance Agent Help?

Your home is one of your most valuable assets. Understanding your insurance coverage can help you be prepared for any unexpected situations that may arise. A good place to start is with an Illinois independent insurance agent.

An agent will speak with you, free of charge, to learn about your home and insurance needs. If you have an existing policy, they'll review your coverage and make recommendations about any gaps in your policy. They can also get you set up with a new policy and make sure you're protected long before you need it.

Article reviewed by | Paul Martin

https://www.esfi.org/home-electrical-fires/

https://www.4abc.com/blog/the-7-most-common-causes-of-electrical-fires-in-the-home

https://www.iii.org/article/homeowners-insurance-basics