Quick Content Navigation

- What Is the Average Cost of Farm Insurance in Illinois?

- What Does Farm Insurance Cover?

- What Doesn't Farm Insurance Cover in Illinois?

- How Much Does Illinois Farm Equipment Insurance Cost?

- What Does Farm Equipment Insurance Cover?

- Does Farm Insurance Cover Transportation of Products in Illinois?

- How an Illinois Independent Insurance Agent Can Help You

It may come as a surprise that 75% of the total land area of Illinois farmland. The state is a leading producer of corn, soybeans, and swine, which is why farm owners want to protect their property and their commodities with farm insurance.

Farm insurance comes in various shapes and sizes, so it's best to seek assistance from an Illinois independent insurance agent. An agent can shop for different carriers and get your farm the insurance it needs based on your individual risks. Here's why farm insurance is so important to farm owners in Illinois.

Illinois farm facts

- Illinois is home to 72,000 farms

- Illinois farmland covers 27 million acres

- The average size of a farm in Illinois is 375 acres

- Illinois' agricultural commodities generate more than $19 billion annually

- Corn is the most profitable commodity in Illinois

- Illinois ranks first in the nation with $180 billion in processed food sales

- The state is home to 2,640 manufacturing companies

What Is the Average Cost of Farm Insurance in Illinois?

The cost of any insurance is specific to your personal needs and situation. For farm owners in Illinois, purchasing insurance depends on factors like the size of your farm, the commodities you're producing, the equipment you run, the number of employees, and other factors.

When building your farm insurance package with your independent insurance agent, you'll have the option to include many add-ons and options. All of them could affect your price. Here are just a few of the most common.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As you can see, it's nearly impossible to predict the cost of farm insurance, but your Illinois insurance agent can break down different pricing options for you and provide you with estimates.

What Does Farm Insurance Cover?

Farm insurance is designed to cover all aspects of your farm. This includes your personal property, which is typically broken down into farm machinery, livestock, and farm products. A typical farm insurance policy will include the following:

- Liability coverage: This provides protection and reimbursement for any medical or legal expenses that arise from a third-party injury or property damage. Things like slips and falls or accidentally knocking down a neighbors fence would all be covered.

- Machinery and equipment coverage: Most farms require a lot of machinery to run smoothly. This coverage pays for damage and repairs for your tractors, combines, cotton pickers, planters, hay rakes, and other farm equipment. You can often even expand this coverage to include portable fences and structures.

- Livestock: 22% of Illinois farms have cows and 3% have swine. If your livestock is injured or killed in a covered peril such as a fire, collision, being struck by a vehicle, or the, like then your farm insurance will cover the financial loss.

- Farm products: Your farm products include fertilizers, seeds, silage, pesticides, and similar products, and they are all covered under your farm insurance. However, it's important to note that they are only covered before they've been planted or used. An example of a covered event would be if a fire burns down the barn where you're storing all of your fertilizer.

What Doesn't Farm Insurance Cover in Illinois?

The most important thing to note that is not covered under farm insurance is the protection of your crops. They must be insured separately under a crop insurance plan. There are some additional exclusions you'll want to keep in mind when considering farm insurance, including:

- Chemical drift

- Fencing

- Machinery under all perils

- Excluded fire events

According to insurance expert Paul Martin, the great thing about farm insurance is that you start with a blank slate then add on the coverages you need. "Even though there are some exclusions, most can be covered through a rider or an add-on to get comprehensive protection."

What Does Farm Equipment Insurance Cost in Illinois?

Farm equipment insurance is designed to specifically cover the backbone of your farm: the machinery and equipment you use. Depending on the type of farm you have, this could be one piece of equipment or multiple pieces, and farm equipment is not cheap. According to AG Daily, the typical John Deere combine starts at $300,000 and tractors can get up to $700,000 or more.

Martin notes that equipment can be covered in general farm insurance, but if you own a lot of expensive equipment, it might be worth it to insure each piece of machinery individually.

There's no real way to put a price tag on farm equipment insurance, but typically you'll pay around $15 per $1,000 of value. Anytime you have a claim against your farm equipment policy you'll be responsible for your deductible before your insurance will pay the claim.

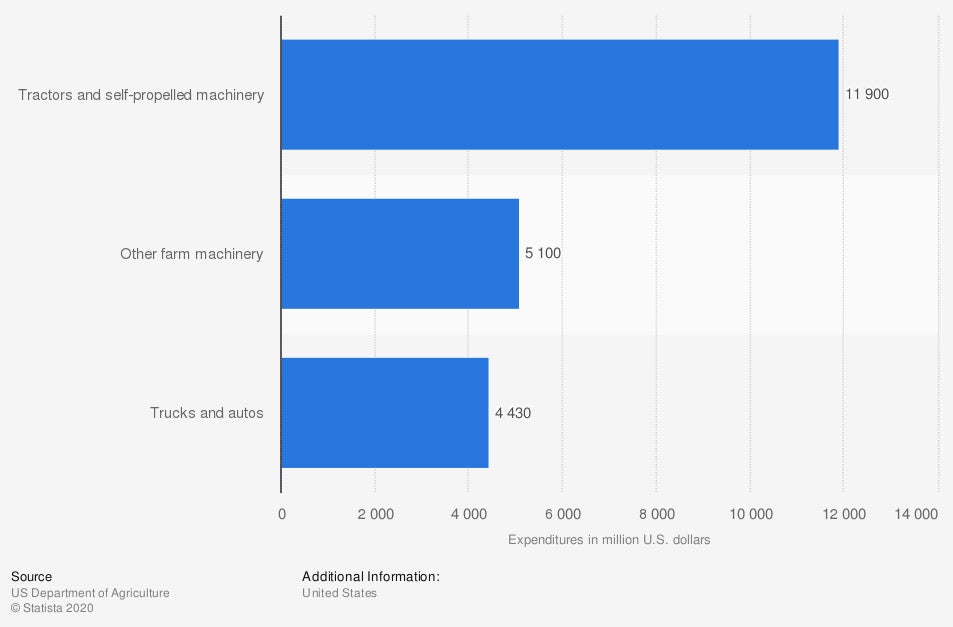

Farm production expenditures on machinery by US farms in 2019, by type

(in million US dollars)

US farms spent $11.9 dollars on tractors and self-propelled farm machinery in 2019.

What Does Farm Equipment Insurance Cover?

It takes a lot of stuff to run a farm, and any number of things could go wrong involving your equipment. Your equipment coverage will protect all of the machinery and equipment below.

- Combines

- Forage harvesters

- Hay rakes and wagons

- Planters

- Sprayers

- Tractors

- Other field equipment

- Farm office equipment

- Irrigation equipment

- Tools and supplies

Each of these tools is covered against specific perils. These perils include fire, lightning, windstorms, hail, smoke, theft and vandalism, and collisions. This means that if any of the above equipment is damaged by these perils, your farm equipment insurance will help pay for repairs and replacement.

Does Farm Insurance Cover Transportation of Products in Illinois?

If you will be transporting your commodities from your farm to a different location in or out of state, it will most likely not be covered by your farm insurance.

This is important to note, as accidents can happen during transportation. What if a truck full of corn is on its way to the West Coast and catches fire? What happens if new livestock is being brought in and there's an accident? These perils can be covered with the proper insurance. In this case, the protection you need is inland marine insurance. This covers products, materials, and equipment that are being transported over land via a truck or train.

How an Illinois Independent Insurance Agent Can Help You

Illinois receives billions of dollars every year for agriculture-related business. Whether it's through farming, manufacturing, or processing, the farming industry is critical to the economy. In order to keep your property, crops, and equipment protected, you need the best farm insurance you can find. Fortunately, an Illinois independent insurance agent is an expert in all business insurance, including farm insurance. They will assist in listing out all of your assets, consider your risks, and help you build a policy that fits your farm.

Should you need to make adjustments or file a claim, your insurance agent will be there to guarantee a convenient process. Find a local Illinois independent insurance agent today.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www2.illinois.gov/sites/agr/About/Pages/Facts-About-Illinois-Agriculture.aspx#h1

https://farmdocdaily.illinois.edu/2021/02/higher-2021-crop-insurance-premiums-and-2021-decisions.html

https://www.agdaily.com/insights/true-financial-cost-modern-farming/

© 2025, Consumer Agent Portal, LLC. All rights reserved.