Though you may not think it could happen to you, one day you might find yourself relaxing on your couch when a golf ball comes sailing through your front window. After cleaning up the shattered glass, someone’s got to file a claim. But what if the golf ball wasn’t yours? Who’s responsible for this mess, anyway?

Fortunately an Illinois independent insurance agent can not only answer this question for you, but also help you get protected by the right homeowners insurance. They know just what coverage you need, and they’ll get you equipped with it before you ever have to file a claim. First, here’s how homeowners insurance would work in this strange scenario.

Who’s Responsible for Paying the Damages If a Golf Ball Breaks My Window?

Your Illinois homeowners insurance would most likely cover you if a golf ball smashed your window, if it wasn’t you who hit it. If you could track down the person who threw or hit the golf ball, you could press charges against them, but that might be a difficult and futile task.

It’s safe to assume you’d be filing a claim through your own homeowners policy. Fortunately it provides coverage for even strange incidents like this one. An independent insurance agent can help you review your policy to see how.

Would I Ever Be Responsible for a Golf Ball Breaking My Window?

According to insurance expert Paul Martin, if you live on a golf course, then the damage from a stray golf ball through your window would more than likely fall on you. You assume this extra risk when you buy or rent a property on a golf course, where stray golf balls are the most common threat to homeowners. If you live on a golf course, be prepared to pay for shattered windows out of your own pocket.

How Much Would I Have to Pay for the Golf Ball’s Damage?

It might come down to a question of if the damage exceeds the amount of your policy’s deductible. The value of your shattered window might amount to less than you’d have to pay out of pocket toward a deductible before your homeowners insurance would kick in to cover the rest of the damage.

Of course, you can work with an independent insurance agent to lower your policy’s deductible to avoid situations like this. Otherwise, your homeowners insurance should cover the damage, as long as you don’t live on a golf course.

How Common Are Golf Balls Through the Window?

Golf balls and other stray objects striking a home’s window might happen more frequently than you’d expect. To gauge the likelihood of this specific incident, take a look at the golfing industry’s presence in the US overall.

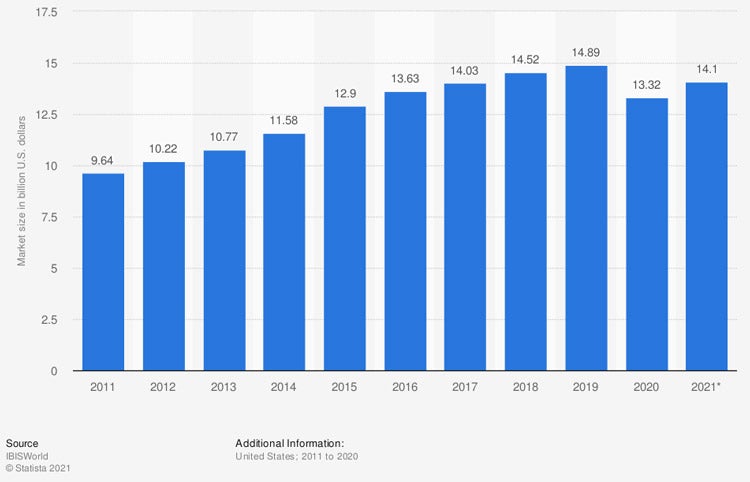

Market size of the golf driving ranges & family fun centers industry in the US

Golf driving ranges have consistently remained a $10 billion industry or more over the past several years. By the end of the studied period, golf driving ranges had increased from $9.64 billion in annual revenue to $14.1 billion.

With golf and driving ranges continuing to increase in popularity and profits, it’s becoming more and more likely your home could get struck by a golf ball.

What Else Does Homeowners Insurance Cover in Illinois?

Illinois homeowners insurance provides protection for your home in many ways, not just from vicious golf balls. Some of the main coverages provided by home insurance are:

- Dwelling coverage: Protects the exterior of the home or its structure from threats like storm damage, fire, vandalism, killer golf balls, etc.

- Liability coverage: Protects against lawsuits filed by third parties by reimbursing for legal costs like attorney and court fees.

- Contents coverage: Protects your stuff like clothing, silverware, technology, music collections, etc. from disasters like fire, theft, etc.

- Additional living expenses coverage: Protects against additional expenses if your home needs repairs and you have to live elsewhere, by reimbursing for costs like hotel stays, additional mileage, meal takeout, etc.

An Illinois independent insurance agent can outline the coverages included in your homeowners insurance policy.

What Won’t My Illinois Homeowners Insurance Cover?

Like every other kind of coverage, your homeowners policy comes with certain exclusions. Commonly excluded disasters under Illinois home insurance are:

- Business-related liability

- Earthquake damage

- Homeowner negligence

- Natural flood damage

- War or nuclear fallout

- Insect infestations

An Illinois independent insurance agent can help you add more coverage to your home insurance policy if you’re concerned about any of these exclusions.

Here’s How an Illinois Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced disasters and liabilities. Illinois independent insurance agents shop multiple carriers to find providers who specialize in homeowners insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeff Green

https://www.statista.com/statistics/1174931/driving-ranges-family-fun-centers-market-size/

https://www.iii.org/article/what-covered-standard-homeowners-policy

© 2025, Consumer Agent Portal, LLC. All rights reserved.