According to Illinois law, any driver involved in an auto accident that includes damage to another person's vehicle or property must stay at the scene, but not everyone always follows the law. Leaving the scene of an accident where there is property damage or bodily harm is considered a hit and run. If you're involved in a hit and run in Illinois, will your car insurance cover it?

Car insurance has required coverages and optional coverages, and the optional coverages are typically the ones that would help you in a hit and run. That's why working with an Illinois independent insurance agent is a good idea. They'll get you set up with the coverage you need to be fully protected on and off the road.

Someone Hit My Car and Took Off; Who Pays for the Damage?

You're stranded on the side of the road with a damaged vehicle, and the person that caused the accident is nowhere to be found. Who pays for this mess? Unfortunately, since the other driver took off, the financial responsibility falls in your hands. The good news is that your Illinois car insurance will help cover the damage.

Any time you get into a car accident, you can contact your independent insurance agent to make sure you're taking the proper next steps. They'll help you get in touch with your auto insurance carrier to file a claim. You should also call the police so they can collect information from you. If possible, try to remember the following details about the accident.

- Exact location

- The sequence of events that led to the accident

- The make and model of the vehicle that hit you

- The color of the car that hit you

- The license plate number of the car that hit you (even if incomplete)

- Any description of the driver

All of this information helps the police find the person that hit you. If they can find them, they can be charged for the damage and reimburse your insurance company.

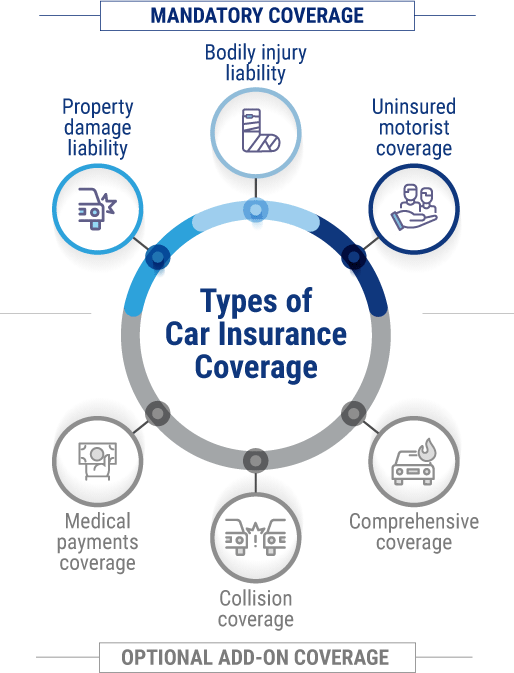

What Coverages Does Illinois Car Insurance Offer?

Nearly every state has a minimum set of car insurance coverages that all drivers must carry. In Illinois, this includes liability insurance, which covers property damage and injuries you may cause to others in an accident. It would help if you carried this insurance in the following minimum amounts:

- Bodily injury liability: $25,000 for injury or death of one person in an accident, $50,000 for injury or death of more than one person in an accident. If you're sued, this coverage pays for third-party medical expenses and legal fees.

- Property damage liability: $20,000 for damage to property of another person. This coverage pays for damage you cause to someone else's vehicle or property.

Illinois also requires that drivers carry uninsured motorist coverage.

- Uninsured motorist coverage: $25,000 per person and $50,000 per accident. This coverage pays for damage to your vehicle and personal injuries if you're in an accident with an uninsured or underinsured motorist.

Some essential but optional add-on car insurance coverages in Illinois include:

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Medical payments coverage: Pays for personal injuries in an at-fault accident or after a hit and run.

What Other Accident Coverages Does Car Insurance Include?

In the event of an accident, several coverages will help pay for the damage. After a hit and run, your car insurance company will first look to your uninsured motorist policy to cover the damage.

Even though there are laws that say you need insurance, 13.7% of drivers are uninsured in Illinois. If you're in an accident with an uninsured driver or a driver leaves the scene of an accident, uninsured coverage is designed to pay for any damage to your vehicle, personal injuries, and any damaged property. If you didn't have uninsured motorist coverage, you could file the claim under your collision insurance, but you'd be likely to pay a higher deductible.

In addition to uninsured motorist coverage, car insurance can include a few other policies that can help after an accident:

- Towing and roadside assistance: This coverage can help get your vehicle off the side of the road and to a repair shop.

- Rental reimbursement: This coverage pays for a rental car while your vehicle is being repaired.

- Gap insurance: If you're in an accident that totals your vehicle, gap insurance pays your car's current value. If you have a loan on your vehicle and you owe more than the car is worth, gap insurance covers the difference.

An Illinois independent insurance agent can walk through different add-ons with you and determine the best options for you.

Is Illinois a No-Fault State? What Is No-Fault/PIP Coverage?

Illinois is an at-fault state, which means that any person who causes an accident is responsible for paying any compensation related to that accident. This includes compensation for any injuries and property damage.

Only 12 states in the US are considered "no-fault" states, which means that each driver is responsible for insuring themselves. In a no-fault state, if you were in an accident that resulted in personal injury, you would file a claim with your insurance, whether you were at fault or not. No-fault states require drivers to get personal injury protection (PIP) to help pay for injuries. PIP is not available in at-fault states like Illinois, but similar coverage, referred to as medical payments coverage, is available in at-fault states.

Even in a no-fault state, if there was property damage, it would be covered by the property damage liability insurance of the driver who caused the accident.

Will My Rates Increase Even if the Crash Isn’t My Fault?

Car insurance rates increase for a variety of reasons. Sadly, whether or not you caused the accident is usually not factored into the increase. Rates will increase depending on the severity of the accident and the amount your insurance policy has to pay out.

Some car insurance companies can increase your premium by as much as 10% after an accident. Every company approaches rate increases differently. Your agent can help you determine how an accident may impact your rates.

What Are the Charges If a Driver Commits a Hit and Run in Illinois?

Leaving the scene of an accident in Illinois is a Class A misdemeanor, meaning the driver could be punished up to the maximum penalty. Under a Class A misdemeanor, this includes:

- Up to 12 months in jail

- Up to $2,500 fine plus court assessments

- 12-month driver's license suspension if you're convicted of a hit and run, and the damage to the vehicle is over $1,000

If the accident involves death or serious injury, the penalty can be increased to a Class 4 felony, resulting in 1-3 years in prison, a fine of up to $25,000, and a complete revocation of the license.

How Can an Illinois Independent Insurance Agent Help?

Illinois independent insurance agents are experts in auto insurance. Agents are not tied to a specific company, but rather work for you. For this reason, they'll shop multiple quotes to find a policy that fits your needs and your budget.

Agents are always available to assist you if you need to file a claim or adjust your insurance. If you find yourself in a hit and run, an agent can help you work with your insurance company and get your vehicle back on the road as soon as possible.

Article Reviewed by | Paul Martin

https://www.illinoisdriverslicensereinstatementlawyer.com/leaving-the-scene-of-an-accident.html

https://www.ilsos.gov/publications/pdf_publications/vsd361.pdf

https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists

https://www.kbb.com/car-advice/insurance/add-ons-car-insurance/