Quick Content Navigation

- What to Do after a House Fire with No Insurance in Illinois

- Can You Get Insurance after a House Fire?

- Average House Fire Costs in Illinois

- How Long Do You Need Insurance for a House Fire to Be Covered?

- When Won't Insurance Cover a House Fire?

- How an Illinois Independent Insurance Agent Can Help You

Every year, around 3% of the house calls that the Illinois fire department answers are in regards to fire. While this might not seem too high, fire and lightning are the second most common claims on homeowners insurance. If your house caught on fire without insurance, you'd be left paying for any damage out of pocket.

Fire damage can be thousands of dollars, so it's best to not tempt fate and make sure your home is adequately protected. A good place to start is with an Illinois independent insurance agent, who can help you purchase fire insurance for your home.

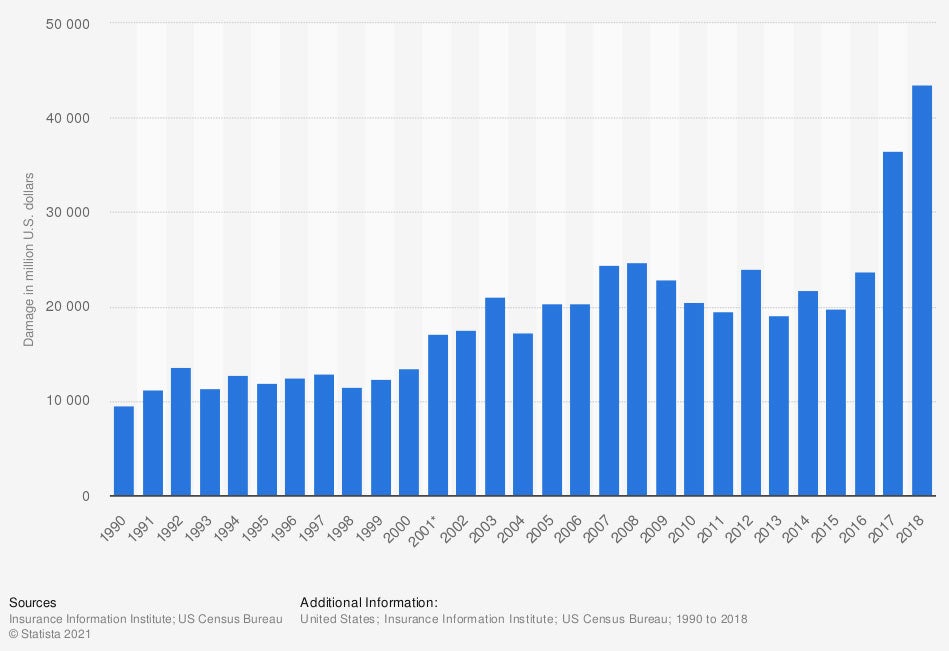

Total incurred losses due to fire in the US from 1990 to 2018 (in million US dollars)

About $43.58 billion in damage was caused by fires in 2019.

What to Do after a House Fire with No Insurance in Illinois

Experiencing a house fire is a devastating event that can be made even more devastating if you don't have insurance. Not only has your home most likely suffered serious damage, but chances are you've lost much of your belongings and personal assets as well. You may even be displaced from your home for a period of time.

Unfortunately, without insurance, all the physical and financial clean-up will be in your hands. While you won't receive financial assistance from your insurance, there are a few steps you can take to get some relief.

Step 1: Keep safety in mind

Insurance or not, never enter a home after a fire if the foundation seems unsafe or unless you're positive it's safe to do so. Make sure to check yourself and anyone else who was in the house for any injuries that may need to be treated.

Step 2: See what your homeowners insurance covers

If you have homeowners insurance it, includes fire damage coverage. While fire insurance can be purchased separately, it's a good idea to check in with your Illinois independent insurance agent to see if your homeowners policy will cover any of the damage.

Step 3: Contact the Red Cross or other local resources

The biggest downside of not having insurance is that you have no means of getting financially reimbursed for any of your possessions that are lost. The Red Cross, in addition to local shelters, can provide resources to help you get through the time until you can rebuild or move back into your home.

Step 4: Get creative with lowering your bills

You'll have a lot of bills after a house fire with no insurance, so it'll help to try to cut your bills in any way possible. Some easy ways include turning off your utilities, removing your internet and cable, and cutting off any other home bills that don't need to be paid if you're not living in the house.

The worst thing you can do after a house fire is dwell on the fact that you didn't have insurance. Dealing with a burned house and ruined possessions is a stressful time. Take the above actions to start getting back on your feet and moving in the right direction.

Can You Get Insurance after a House Fire?

Yes, you can get insurance after a house fire. It's recommended that you do so, especially if you're in a high-risk area for fires. According to insurance expert Paul Martin, it's important to note that no matter when you purchase insurance, if it's after the fire, it will not retroactively cover the house fire or any damage that was done. But that doesn't mean that fire insurance is not important to have.

The good news is that fire damage is typically covered in your Illinois homeowners insurance policy. It will cover fire damage to your property, home, and personal possessions, and may even provide assistance for temporary lodging. If your home is in a high-risk area that is prone to fires, then you'll want to consider purchasing fire insurance through Fair Access to Insurance Requirements (FAIR) Plans.

FAIR Plans are designed to provide insurance to those living in areas that are prone to high risks, such as fires. FAIR plans allow homeowners to get extra fire insurance if it's not adequately available through a homeowners policy.

Average House Fire Costs in Illinois

House fires are a costly event. If you're lucky it'll only run you a few hundred or thousand dollars in loss, but if your entire home burns down you're looking at hundreds of thousands of dollars.

- Nationally, homeowners pay $2,945 to $31,251 for smoke and fire clean up after an event.

- The national average for fire repair is $15,445.

- In 2019, fires caused $14.8 billion in property damage.

- In 2019, property loss caused by fires in structures in the United States amounted to $12.87 billion. The cost of a house fire and the cost to clean up will depend on a variety of factors, including the extent of the damage, potential costs in water cleanup, chemical repair from extinguishers, soot removal, and smoke damage restoration.

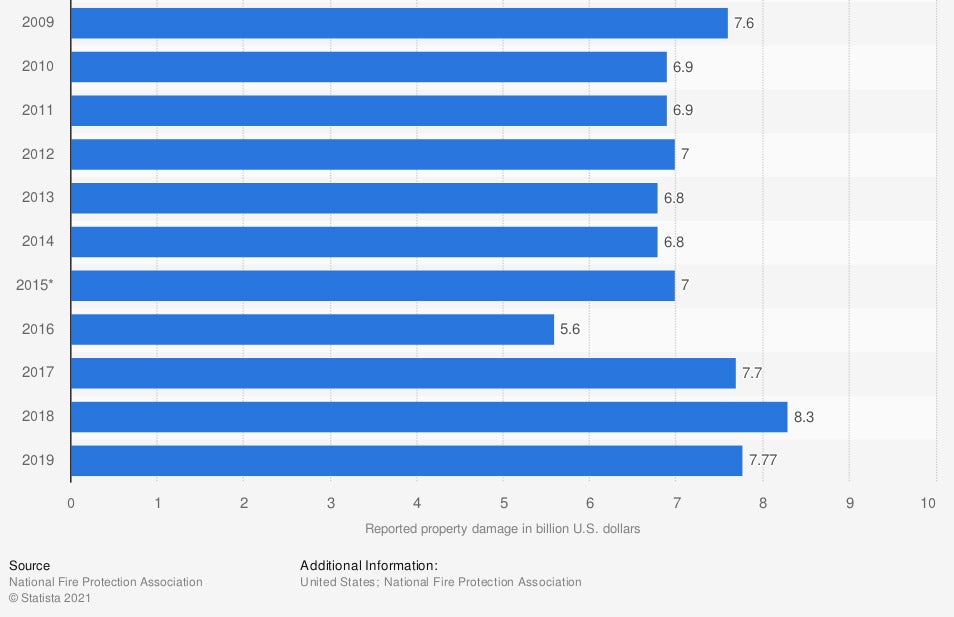

Reported direct property damage caused by home structure fires in the United States from 2009 to 2019 (in billion US dollars)

In 2019, about 339,500 home structure fires were reported in the United States, which caused property damage of about $7.7 billion.

How Long Do You Need Insurance for a House Fire to Be Covered?

According to Martin, as soon as you buy insurance, a house fire will be covered. "The purchasing process is called a binding agreement where the insurance agent can verbally put the contract into effect," said Martin.

As soon as the insurance contract is put into effect, it's referred to as the effective date. As long as the house fire occurs after the effective date and before the expiration date, then any damage caused by the fire would be covered.

When Won't Insurance Cover a House Fire?

While insurance can definitely ease the financial stress of a house, fire it won't cover all events. Even fire insurance has exclusions that any Illinois homeowner will want to be aware of. These include:

- Arson

- Acts of war

- Properties that have been vacant for 30 days or more

- Nuclear hazards

- Morale hazard: A fire that occurs because of poor property maintenance

- Moral hazard: A fire that occurs from someone trying to cheat and defraud the company

Whether you accidentally start a fire while you're cooking, or a thunderstorm sparks fire in your home, if you have homeowners insurance, then the damage to your home, property, and possessions will be a covered claim under your insurance policy.

How an Illinois Independent Insurance Agent Can Help You

Fire and lightning damage claims are one of the most common claims on homeowners insurance policies. If you're caught in a house fire without insurance, you could feel at a loss and not be sure where to turn. An Illinois independent insurance agent can help get you back on your feet and properly insured if your insurance is lacking the proper fire protection. Whether you're looking to purchase new insurance or upgrade your existing policy, they're experts in homeowners and fire insurance and can help you build a policy package to fit your needs.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.homeadvisor.com/cost/disaster-recovery/repair-fire-and-smoke-damage/

https://www.usfa.fema.gov/data/statistics/states/illinois.html

https://www.iii.org/article/what-if-i-cant-get-coverage

© 2025, Consumer Agent Portal, LLC. All rights reserved.