Drivers have all kinds of risks they need to keep in mind and plan ahead for before they ever hit the road, and the safety of their passengers is one of the top priorities. Since accidents unfortunately can and do happen, it’s important to understand what all is included in your coverage ahead of time.

Fortunately an Illinois independent insurance agent can not only help you get set up with the right car insurance for you, but also help you understand what’s included in your policy. They’ll make sure you’re adequately covered long before you ever need to file a claim. But first, here’s a deep dive into car insurance.

What Does Car Insurance Cover in Illinois?

The coverage provided by your Illinois car insurance will depend on which type of coverage you purchase, and there are several options out there. However, according to insurance expert Paul Martin, folks most commonly purchase the following types of car insurance:

- Collision car coverage: This coverage protects against collisions with other vehicles as well as other property like buildings, fences, signposts, etc.

- Comprehensive car coverage: This coverage protects against collisions with large animals, as well as several other disasters not included in collision coverage, like windshield breakage, flood damage, theft, and more.

An Illinois independent insurance agent can help you find all the car insurance coverage you need to feel safe on and off the road.

What Doesn’t Car Insurance Cover in Illinois?

Though car insurance in Illinois provides a lot of important protection, it still comes with certain exclusions, no matter which type of coverage you purchase. Martin says that some of the most common car insurance exclusions are:

- Business use: To protect your personal vehicle from disasters that happen while using it for business purposes, you’ll need a commercial auto insurance policy.

- Personal belongings: Your car insurance policy almost never covers personal belongings inside your car if they get stolen. However, your Illinois home insurance or renters insurance might.

- Routine maintenance: Car insurance does not cover the cost of upkeep of your vehicle.

- Ridesharing vehicles: Standard car insurance does not cover ridesharing vehicles. You’d need a special form of coverage known as rideshare insurance for that.

Your Illinois independent insurance agent can help address any concerns you may have about your car insurance policy’s exclusions.

Is My Child Protected If I’m in the Wrong?

If you caused an accident, you’d understandably be worried about whether your car insurance policy would cover your family and other passengers, including your children. According to insurance expert Jeffery Green, if you don’t live in a no-fault state, you would need medical payments coverage to protect your child if you cause an accident.

Green said that if you do live in a no-fault state, your child would be protected under your regular car insurance policy if you’re in the wrong. An Illinois independent insurance agent can help you determine if you need to add medical payments coverage to your car insurance to protect your child in case of an accident you cause.

How Common Are Fatal Car Accidents in the US?

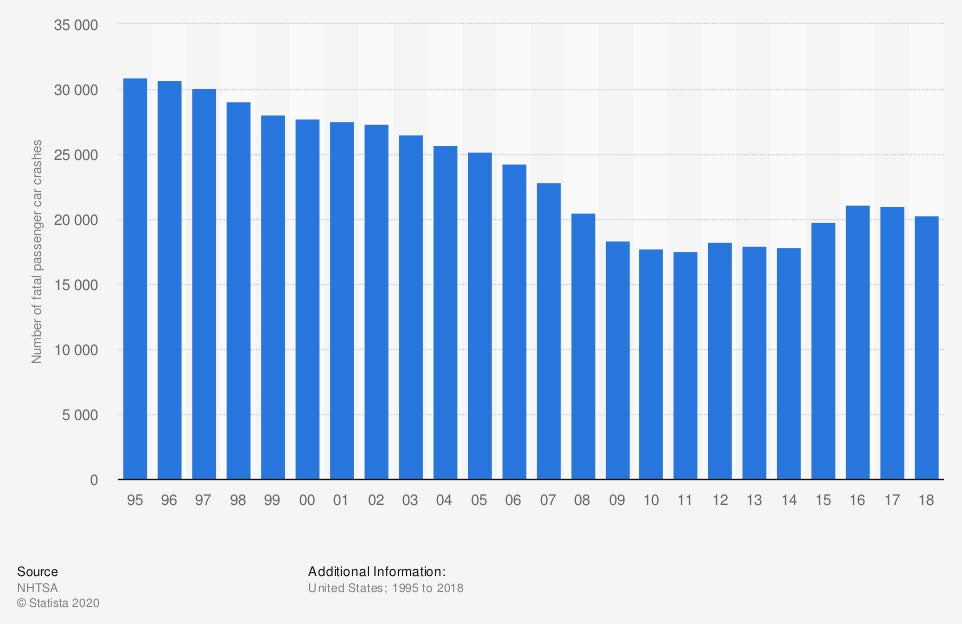

When shopping for car insurance, you’re likely to be curious about just how often drivers actually use their coverage for disasters. Take a look at some alarming stats for fatal crashes in the US below to get a better idea.

Number of passenger cars involved in fatal crashes in the United States

Fortunately, the number of fatal crashes involving passenger vehicles in the US has decreased quite a bit since 1995, when nearly 31,000 fatal accidents were reported in one year. In 2018, this number had fallen by about a third, to 20,333 fatal accidents.

Though the number of fatal passenger car accidents has declined in recent years, it’s still a fairly common occurrence. That’s just one more reason why it’s so important to not only be equipped with the proper car insurance coverage, but to also be extra careful when behind the wheel.

Is My Child Protected If the Other Driver Flees the Scene of the Accident?

Green said that if you live in a no-fault state, then yes, your child would be protected if you got into an accident with another driver who fled the scene. If you don’t live in a no-fault state, an uninsured motorist bodily injury insurance policy would cover your child. An Illinois independent insurance agent can help you add this coverage if necessary.

What If My Child Requires Intensive Medical Care, Such as Surgery?

Green said that there are two coverages that could protect your child if they require intensive medical care, like surgery. Your health insurance could cover your child after an accident and injury, or you could go through personal injury protection or medical payments coverage under your auto insurance policy.

Green added that the coverage that pays first will depend on the state you live in. In many states, your auto insurance coverage would pay for your child’s injuries first, up to its policy limits, and then your health insurance would kick in to cover the rest. An Illinois independent insurance agent can help you review your coverages to find out for sure.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting drivers and their children against injuries after an accident, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in auto insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

graph - https://www.statista.com/statistics/191530/fatal-passenger-car-crashes-in-the-us/

https://www.iii.org/article/homeowners-insurance-basics

https://www.iii.org/article/auto-insurance-basics-understanding-your-coverage