When your roof is in need of repair, you need to be sure the job gets done right. But you also don't want any crooks claiming that your roof needs to be fixed when it actually doesn't. That's why you've got to know about the common roofing insurance scams happening in Illinois to protect yourself.

An Illinois independent insurance agent can help you get equipped with the right homeowners insurance so you can get your roof repaired legitimately. But it's also important to begin with knowing the signs of roofing insurance scams in your area. Check out this guide to get started.

What Are Roofer Scams?

Roofer scams, or roofing insurance scams, happen to folks in Illinois just like they do everywhere else. They start with an untrustworthy individual who claims to be a roofing contractor that's either going to offer you the deal of a lifetime to repair your roof, or demands a ton of money before starting on the project.

No matter how a specific roofer scam is disguised, its end goal is always to charm you out of your hard-earned money without delivering the promised work in return. Roofing insurance scams can leave you with unfinished or poorly executed roof repairs, or even more damage than existed before.

Protecting Yourself from Illinois Roofing Insurance Scams

Being proactive is the best defense against roofing insurance scams in Illinois. That means before you ever sign a contract or hand over money to a contractor, start with a preinterview. Make it a rule to never hire someone to begin working on your home until you've asked them for the following information:

- Proof of their business's license or bond

- Proof of insurance like contractors liability insurance and workers' comp

- Their business's contact information, including its address, tax ID number, and phone number

- A list of past completed projects on roofs

- A list of references

- Their supervisor's name and contact information

- A roofing warranty to look for gray areas in the contract

- A written proposal with the project's specs and estimated timeline for completion

Don't end this process here, though. Before you agree to let the contractor work on your roof, do a little extra homework and look for reviews of them online. If a bunch of customer complaints pop up, that's a huge red flag.

Why It's Important to Avoid Roofing Insurance Scams in Illinois

One popular method used by roofing insurance scammers is to ask you to file a claim through your homeowners insurance to pay for the repairs, and then later get you to sign over the check to them. Scammers want you to think you won't have to pay anything yourself for their work, but really you're left with the deductible in the end regardless. You can also be left with fraudulent claims on your homeowners insurance that reflect negatively on you.

Another danger in hiring a scammer is that your roof can be left in worse shape than it was before. Some scammers are notorious for actually causing damage to roofs just so they can demand more money from the homeowner before they complete the project. Your roof may have never even been damaged in the first place, which is why getting an honest, professional inspection is so important.

How to Spot the Most Common Roofing Insurance Scams in Illinois

Fortunately becoming familiar with the most common roofing insurance scams in Illinois can help you spot red flags when they arise. You'll know you're dealing with a potentially shady contractor if:

- They ask for an insurance check: Never sign over your homeowners insurance payouts to anyone else, and never let an outsider file a claim through your insurance for you.

- They want a huge deposit: Some legitimate roofing contractors will ask for deposits up front, which is how scammers can get away with this practice. But if the amount is large enough to seem sketchy, don't ignore it.

- They appear right after a storm: This type of scammer is called a "storm chaser," and has a reputation of showing up on your doorstep after a storm has recently hit your town. They'll claim your roof is in urgent need of repairs, but they won't deliver on their promises.

- They ask for more money: A roofing scammer can be only halfway through their project when they pause their work and come to ask you for more money. They might claim that they need extra materials or that they've discovered new damage, and they'll refuse to continue work until they get paid.

Keep these common roofing insurance scams in mind if anyone ever shows up on your doorstep unannounced and asking to inspect your roof. It's always the safest practice to contact your homeowners insurance company directly if you feel like your roof is in need of repair or inspection.

What Are the Most Common Causes of Roof Damage in Illinois?

Homes in Illinois can be vulnerable to multiple storms throughout the year, since the state experiences all four seasons and all types of weather.

Illinois is most prone to these severe events that can damage roofs:

- Severe thunderstorms

- Flooding

- Tornadoes

- Winter storms

- Earthquakes

- Landslides

- Wildfires

Your Illinois homeowners insurance covers roof damage due to the wind, hail, and lightning that severe thunderstorms bring, as well as damage due to tornadoes, winter storms, and wildfires. However, for flood, landslide, and earthquake damage, you'll need separate coverage. Ask your Illinois independent insurance agent about protecting your roof with a flood insurance or earthquake insurance policy for these perils.

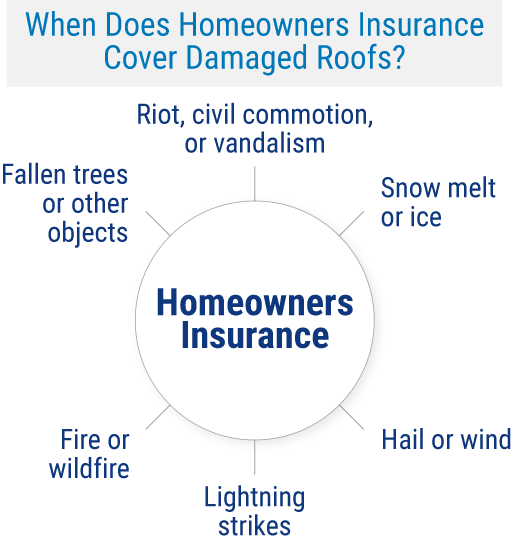

When Does Illinois Homeowners Insurance Cover Damaged Roofs?

Illinois homeowners insurance provides the same standard protection for the dwelling of your home as other policies across the US. If your roof gets damaged due to one of the following disasters, you'll most likely be covered:

- Fallen trees or other objects

- Riot, civil commotion, or vandalism

- Snow melt or ice

- Hail or wind

- Lightning strikes

- Fire or wildfire

Make sure to review your homeowners insurance policy with the help of your Illinois independent insurance agent. They'll help you rest easy knowing that your roof is covered against the most common disasters in your state.

Why Choose an Illinois Independent Insurance Agent?

Illinois independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Illinois independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://crisisequipped.com/what-natural-disasters-occur-in-illinois/

fox4now.com/news/local-news/contractors-promising-a-new-roof-taking-your-rights-and-money-instead

forbes.com/advisor/homeowners-insurance/roof-repair-scams/

© 2025, Consumer Agent Portal, LLC. All rights reserved.