When you run a farm, you've got to make sure all its components are protected against common disasters. One of the most important parts to get coverage for is your crops. Without crop insurance, you could lose an entire season's worth of work after just one incident like a fire.

Fortunately, an Illinois independent insurance agent can help you find the right type of crop insurance for your specific farm's needs. They'll also get you covered long before you need to file a claim. But for starters, here's a closer look at this critical coverage.

What Is Crop Insurance?

Crop insurance is just one type of coverage needed by farmers, and is a component or add-on to an Illinois farm and ranch insurance policy. Crop insurance is designed to protect your crops from many types of disasters like drought, fire, and much more.

There are several types of crop insurance available, from simple crop-hail coverage to multi-peril crop insurance. Depending on your farm's needs and your budget, you may opt for more or less coverage. An Illinois independent insurance agent can help you decide which type of crop insurance is right for you.

What Does Crop Insurance Cover in Illinois?

What your policy covers will depend on the type of crop insurance you choose. If your farm's crops are relatively safe and you're only worried about a couple of specific perils, you might go for a crop-hail policy. However, if you've got a larger farm and many exposures, multi-peril crop insurance might be what you need.

Your Illinois independent insurance agent can advise on the type of crop insurance that'll best cover your farm's needs. Before calling your agent, have a list of your concerns prepared. The two of you will review your specific exposures together, and choose the corresponding policy from there.

What Doesn't Crop Insurance Cover in Illinois?

What's excluded by your crop insurance also depends highly on the type of coverage you select. But in general, crop insurance will never cover these perils:

- Intentional acts

- Malicious acts

- War damage

- Nuclear fallout damage

- Pollution

For the most complete picture of coverage, you might want to look into a multi-peril crop insurance policy.

What Is Multi-Peril Crop Insurance?

Multi-peril crop insurance is sold through the Federal Crop Insurance Program. Coverage is designed to protect your crops more completely than other policies like regular crop insurance or crop-hail insurance. However, coverage is often more expensive than those other policies.

Multi-peril crop insurance covers:

- Hail and wind damage

- Insect damage

- Disease outbreaks

- Drought

- Fire damage

- Flood and frost damage

An Illinois independent insurance agent can help you decide if multi-peril crop insurance makes the most sense for your farm. Multi-peril crop insurance has to be bought before your crops get planted. Coverage also has to be renewed every growing season.

What Is Crop-Hail Insurance?

Crop-hail insurance is more limited, coverage-wise, than multi-peril crop insurance. Crop-hail policies are typically written to cover just hail damage and sometimes fire damage. Coverage can be customized to include more perils, however.

Coverage can be expanded to include protection against:

- Theft

- Wind

- Vandalism

- Lightning

- Frost

- Malicious mischief

An Illinois independent insurance agent can help you find and customize the right crop-hail insurance policy for you.

Where Can I Buy Crop-Hail Insurance?

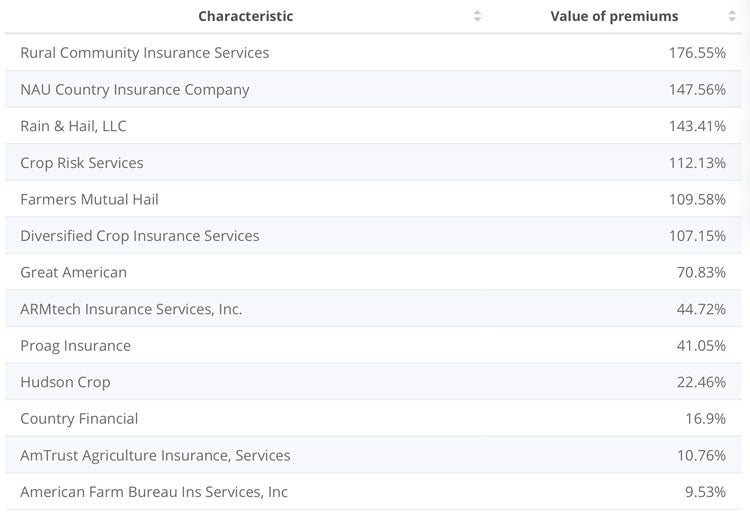

Here's a look at some of the current top-performing crop-hail insurance companies in the US. Keep these in mind before hunting for your own coverage.

Largest crop-hail insurers in the US, by premiums value

The current leading crop-hail insurer by far is Rural Community Insurance Services, with $176.55 million in total written premiums. Next highest are NAU Country Insurance Company ($147.56 million) and Rain & Hail, LLC ($143.41 million).

Your Illinois independent insurance agent can advise you about whether one of these insurance companies is the right choice to meet your crop-hail coverage needs.

How Much Does Crop Insurance Cost in Illinois?

It's hard to predict the cost of your crop insurance policy, because it's determined by a number of different factors. These often include:

- Your farm’s location

- The acreage of crops insured

- The type of crops insured

- Additional coverages added

- The value of crops insured

Farms in bigger, livelier cities often pay more for crop insurance than those in smaller, safer towns. An Illinois independent insurance agent can provide you with crop insurance quotes in your specific area.

Here’s How an Illinois Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect farm owners against commonly faced disasters and liabilities. Illinois independent insurance agents shop multiple carriers to find providers who specialize in crop insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/farms-and-ranches

https://www.statista.com/statistics/791545/leading-crop-hail-insurers-usa-by-premiums/

https://www.iii.org/article/understanding-crop-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.