Insurance Content Navigation

- Is Flood Insurance Required in Illinois?

- What Does Flood Insurance Cover in Illinois?

- What Doesn’t Flood Insurance Cover in Illinois?

- Flood Stats for Illinois

- What Is Considered to Be a Flood?

- How Much Does Flood Insurance Cost in Illinois?

- Here’s How an Illinois Independent Insurance Agent Can Help

Regardless of where you live, there’s typically at least some risk of flooding. And one of your main priorities as a homeowner is to keep your home and other property safe from numerous disasters, including those stemming from nature. That’s why having the right flood insurance is crucial for maintaining your sense of security within your own home.

Fortunately Illinois independent insurance agents can help you get set up with the right flood insurance for your needs. They’ll make sure you walk away with all the coverage necessary, long before you ever need to file a claim. But before that, let’s take a deep dive into flood insurance.

Is Flood Insurance Required in Illinois?

Depending on where you live specifically, it very well might be. Homeowners in areas deemed to be high-risk in Illinois are often required to have flood insurance by their mortgage lenders. But even if you don’t live in a high-risk area, your mortgage lender might still require you to carry flood coverage, to be extra safe. But having flood insurance is not federally required for property owners across the map, though having coverage is always a good idea, to be prepared.

What Does Flood Insurance Cover in Illinois?

Flood insurance in Illinois is meant to protect your home from natural flooding events. Standard homeowners insurance and renters insurance specifically exclude natural flood coverage, so having a flood insurance policy to bridge that gap is critical.

Flood insurance in Illinois covers the following:

- Damage or destruction of your home: aka “structural coverage,” this aspect of flood insurance protects the foundation of your home, or the dwelling, as well as indoor plumbing, built-in appliances, electrical systems, and carpeting or other additional flooring, against natural flood damage. Sheds and other detached structures may be covered, too.

- Damage or destruction of your stuff: aka “contents coverage,” this aspect of flood insurance protects your furniture, other appliances, some food, valuables, and clothing against natural flood damage.

Flood insurance typically factors in the depreciation of your property’s value when paying out a claim. However, depending on the type of claim filed, certain events may qualify for the original replacement cost of the item. An Illinois independent insurance agent can further explain how flood insurance works.

What Doesn’t Flood Insurance Cover in Illinois?

Flood insurance in Illinois is only meant to cover natural flooding events, so coverage comes with certain exclusions. However, other types of flooding events are often covered by homeowners insurance. Flood insurance in Illinois tends to exclude the following:

- Flooding caused by non-natural water events (e.g., backed-up toilets or sewers)

- Property outside the dwelling like patios, fences, pools, septic systems, and plants

- Natural flooding events that inundate less than two acres of land

- Mold, mildew, or other moisture damage

- Earthquake or mudslide damage

- Additional living expenses*

*Homeowners insurance in Illinois does cover additional living expenses if you’re forced to live elsewhere while repairs are made to your home after a flood. Your Illinois independent insurance agent can help you review other exclusions under flood insurance and help address any concerns you may have.

Flood Stats for Illinois

It can be difficult to grasp the importance of flood insurance until you review the stats, especially for your specific area. Check out some flood stats for Illinois as well as the US overall and see for yourself.

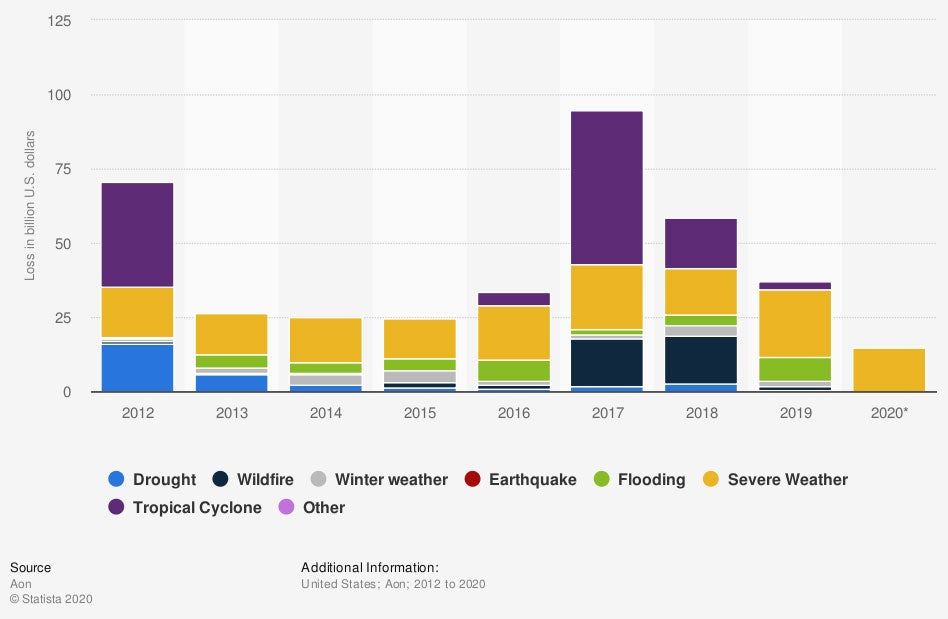

Value of insured losses in the United States from 2012 to 2020, by natural disaster type

(in billion US dollars)

Flooding costs the US billions of dollars in damage almost every year. The two highest insured losses due to flooding over the last decade occurred in 2016 ($7.18 billion) and 2019 ($8.14 billion).

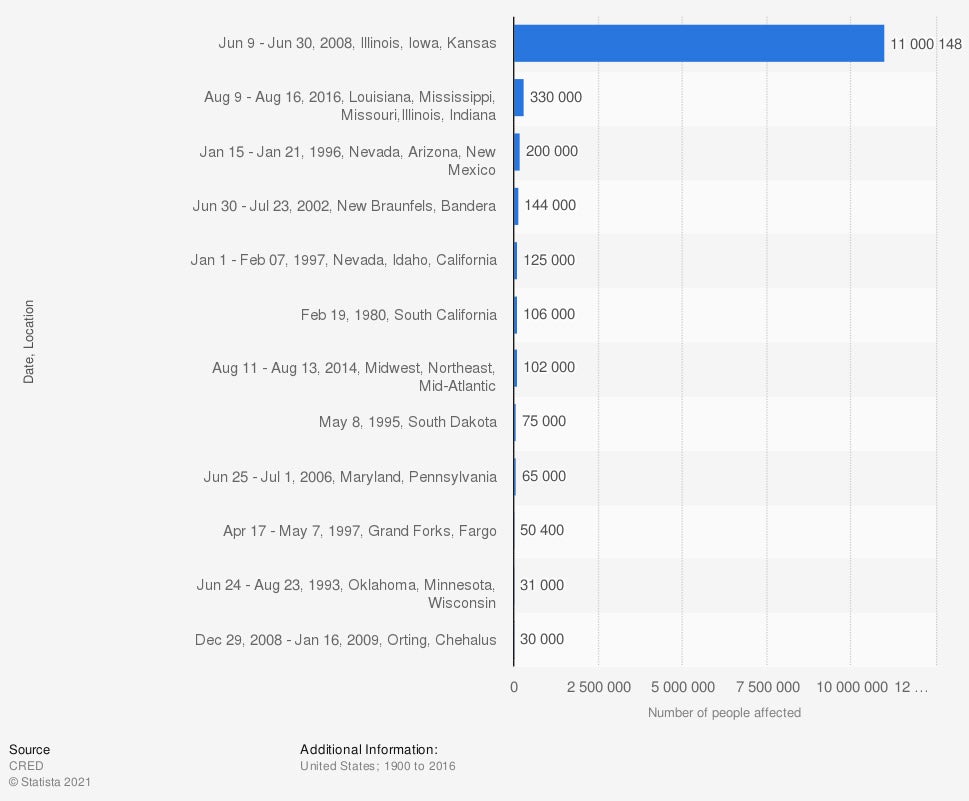

Major flooding events in the United States from 1980 to 2019, by economic cost (in billion US dollars)

Since Illinois isn’t on the coast, to some it may not seem particularly at risk of natural flooding, upon first glance. However, the Midwest region of the country has been susceptible to the costliest flooding events in the US over the past several decades. In 1993, the Midwest region lost $37.9 billion to flood damage, and in 2008, the region lost $12.2 billion to flooding.

Knowing how costly natural flood disasters are to the US, and the Midwest specifically, further proves the importance of flood insurance in Illinois, even if you don’t live in a high-risk area.

What Is Considered to Be a Flood?

According to insurance expert Paul Martin, in order for a flooding event to qualify for reimbursement through flood insurance, it must stem from a natural source. This means the flooding must be caused by events such as prolonged rainfall, hurricanes, snow melt, monsoons, or coastal storm surges.

But other causes of flooding that may be covered include levee dam failures and blocked drainage systems. To qualify for reimbursement through flood insurance, water often must cover at least two acres of normally dry land after the event.

How Much Does Flood Insurance Cost in Illinois?

Flood insurance costs can be hard to estimate, since they depend on numerous factors like exact location, the flooding history of your area, and your home’s elevation. Homeowners in high-risk flood areas will have to pay more for their coverage. Your specific policy’s coverage limits and deductible amounts will also influence the cost of your premium.

The average annual cost of flood insurance in the US is currently about $700. That said, homes located in small towns in Illinois might pay only $300 annually for coverage, while homes in larger, often-flooded towns might pay closer to $3,000 each year. An Illinois independent insurance agent can help you find more specific flood insurance costs in your area.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting homeowners and renters against flood damage losses, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in flood insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.floodsmart.gov/flood-insurance/requirements

chart 1 - https://www.statista.com/statistics/612615/value-of-insured-losses-usa-by-natural-disaster-type/

chart 2 - https://www.statista.com/statistics/1116782/major-floods-us-economic-cost/

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.