When you drive a vehicle you love, you’ve got to make sure it’s protected from all kinds of threats. But before your car ever leaves the driveway, it’s still basically a sitting target for disaster. That’s why it’s so important to make sure you get equipped with the right kind of coverage.

Luckily an Illinois independent insurance agent can get your ride protected by the proper comprehensive car insurance. They’ll even get you covered long before you need to file a claim. But first, here’s a deep dive into this important coverage.

What Is Comprehensive Car Insurance?

Also known as “other than collision” coverage, comprehensive car insurance is one form of Illinois car insurance that offers a fuller picture of protection for drivers. When selecting your car insurance coverage, you’ve got several options. Comprehensive policies are designed to protect against numerous threats that aren’t related to vehicle collisions.

If you really want to protect your vehicle, your best bet is to add comprehensive car insurance to your greater car insurance policy. An Illinois independent insurance agent can help you find the right coverage for your needs.

What Does Comprehensive Car Insurance Cover in Illinois?

Comprehensive car insurance acts just as the name implies, as a more comprehensive type of protection for your vehicle than other policies, such as collision. Comprehensive car insurance protects your vehicle from the following:

- Theft

- Collisions with large animals

- Windshield breakage

- Natural disaster damage (including flooding)

- Riots and vandalism

- Falling objects

An Illinois independent insurance agent will ensure that you walk away with all the coverage you need to protect your car, as well as yourself, on and off the road.

What Isn’t Covered by Comprehensive Car Insurance in Illinois?

Comprehensive car insurance is just one aspect of a complete car insurance package. Because of this, comprehensive car insurance doesn’t cover:

- Business use of your car: You’d need an Illinois commercial auto policy to cover this.

- Liability: You’d need to purchase bodily injury liability and property damage liability to protect yourself against lawsuits. This coverage is probably mandatory in your area, anyway.

- Collisions with other vehicles: You’d go through Illinois collision car coverage for claims relating to collisions with other cars.

An Illinois independent insurance agent can help you assemble a complete auto insurance package.

Do I Need Comprehensive Car Insurance?

While it may not be required by law, comprehensive car insurance is always an important option to consider. Check out some average claim amounts for comprehensive car insurance in the US to better understand why.

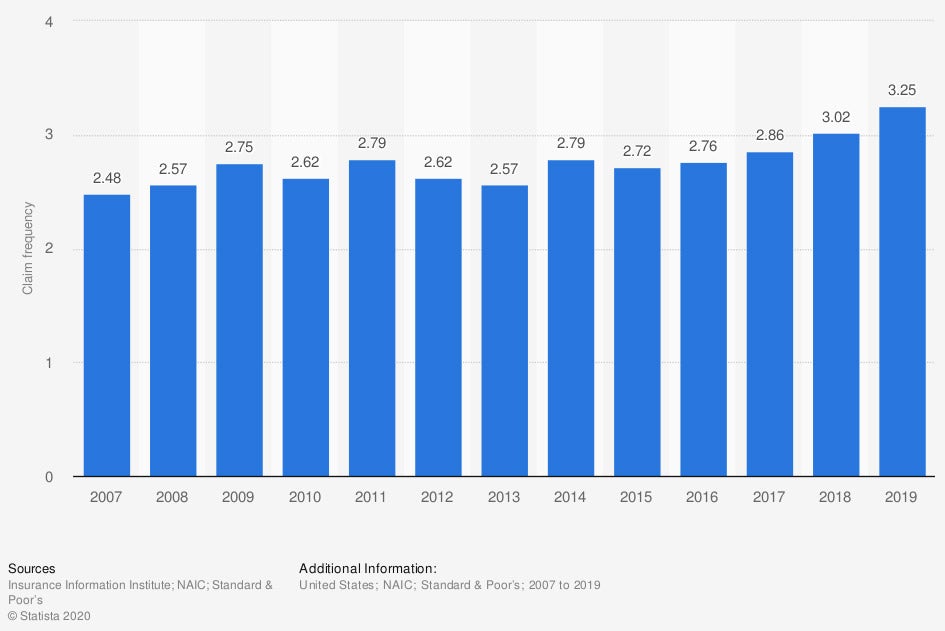

Average value of private passenger auto comprehensive insurance claims for physical damage in the US from 2007 to 2019

In nearly every year of the observed period, the average physical damage comprehensive auto claim amounted to more than $1,500. In 2019, the average claim was $1,780.

Without comprehensive car insurance, that’s a lot of money to have to pay out of pocket after an incident. An Illinois independent insurance agent can further explain the importance of considering comprehensive car insurance.

How Much Does Comprehensive Car Insurance Cost in Illinois?

According to insurance expert Paul Martin, the cost of your comprehensive car insurance policy in Illinois will vary depending on several factors, such as the kind of vehicle you have, its age, and its value. However, the average cost of car insurance in Illinois is $1,079 annually.

There are several factors that impact the cost of your comprehensive car insurance, like:

- Your age

- Your driving record

- Your credit history

- Your car’s make and model

- Your car’s age and value

An Illinois independent insurance agent can help you find quotes for comprehensive car insurance in your area.

Comprehensive Car Insurance vs. Car Insurance

Comprehensive car insurance refers to one specific type of coverage under a larger car insurance policy. Car insurance policies typically come with several components, such as collision, liability, comprehensive, uninsured motorist, etc. However, some drivers opt to cover their vehicles with their state’s minimum insurance requirements, while others go for a more complete coverage blanket.

It’s highly recommended to get as much car insurance coverage as you can afford, Martin said. Without the right type of coverage, you could be stuck paying out of your own pocket for a hefty claim, and possibly even lose your vehicle. Comprehensive car insurance provides a wide net of protection that’s not offered in other policies such as collision. A safe bet is to just get set up with this coverage early on.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting Illinois drivers against disasters like theft, large animal collisions and other threats, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in comprehensive car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

stats - https://www.statista.com/statistics/830189/comprehensive-claim-size-for-physical-damage-usa/

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.