Electronic stores are filled with valuable and entertaining technology, which is why Illinois business owners need to protect their stores from any potential risks. The right business insurance policy will help pay for everything from a slip and fall to faulty equipment.

Working with an Illinois independent insurance agent is an easy and efficient way to find electronics store insurance. They understand the coverage you need and the best place to find it in the state.

What Is Electronics Store Insurance?

Electronics store insurance is a type of business insurance that includes multiple policies that protect your store from any causes of loss that you may experience.

With customers coming in and out of your store and testing your products, and a store full of expensive equipment, you want to make sure you're covered against any exposures.

According to insurance expert Jeffrey Green, most electronics stores can start with a business owners policy and then consider adding additional coverages like equipment breakdown and food spoilage coverage.

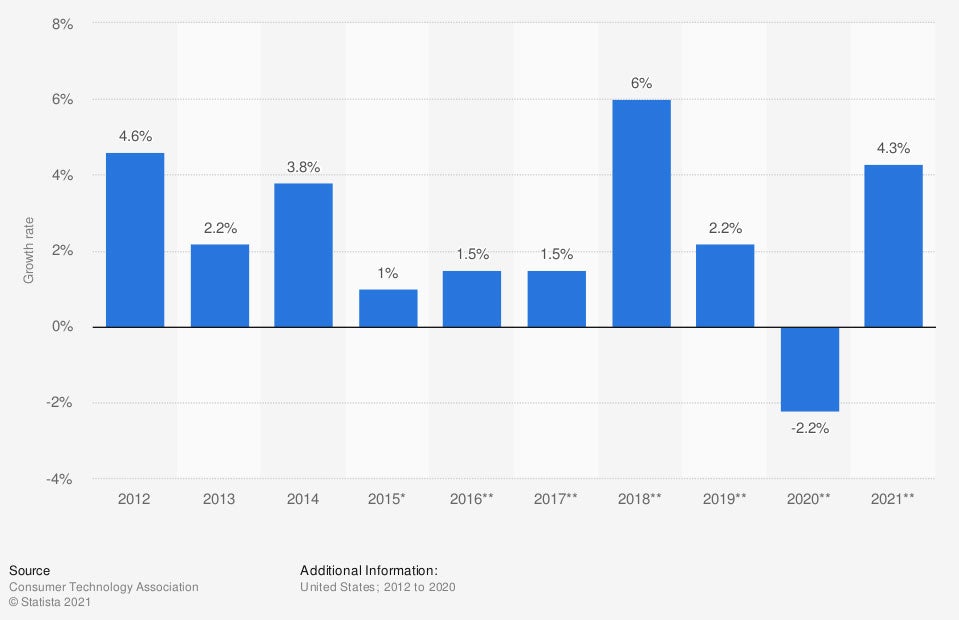

Growth rate of the consumer electronics industry in the US

After a decrease in the consumer electronics industry during COVID, it's expected to grow 4.3% in the next year.

What Does Illinois Electronics Store Insurance Cover?

As Green mentioned, the ideal starting point for most electronics stores is with a business owners package. This includes general liability, property, and business interruption insurance. These policies provide the following coverage:

- General liability: Covers any lawsuits, including legal feels and medical bills, claiming that your electronics store caused bodily injury or property damage to a visitor or customer.

- Commercial property: Covers your business, equipment, inventory, furniture and other physical assets if damaged by fire, lightning, wind, hail, theft, vandalism, and other covered losses.

- Business interruption: Covers any lost income if you cannot open your electronics store because of damage from a covered loss.

Most Illinois electronic store owners can benefit from purchasing the following additional coverages.

- Equipment breakdown insurance: Pays to repair equipment if it breaks down due to mechanical or electrical failure.

- Food spoilage coverage: Pays for any financial loss due to food spoilage should your refrigeration unit break down.

- Cyber liability: Pays for financial damage from a data breach.

What Isn't Covered by Illinois Electronics Store Insurance?

Business insurance is unique in that you can choose specific add-ons to protect against things that standard insurance won't cover, like data breaches or equipment breakdown.

With the coverages listed above, there are still some gaps that you'll find in your electronics store insurance that you may want to discuss with your Illinois independent insurance agent.

- Employee illness or injuries: Employees are only covered under workers' compensation, which is required in Illinois for all business owners.

- Company vehicles: Commercial auto insurance is necessary if you have vehicles you will be using for company operations.

- Damage from flooding or earthquakes: You can purchase flood insurance and earthquake insurance to protect against flood and earthquake damage.

- Intended damage: Insurance policies will never cover damage that was done intentionally to a business.

How Much Is Electronics Store Insurance in Illinois?

Every electronics store's inventory will vary. Some stores may focus on photography and only sell digital cameras, while others sell televisions and computers worth thousands of dollars.

Insurance carriers will take a variety of aspects of your business into consideration when determining the premiums for your electronics store insurance.

Insurance premiums are impacted by the following:

- Business industry

- Age

- Type of inventory

- Location

- Value of inventory

- Previous claims history

- Number of employees

- Potential risks

An Illinois independent insurance agent can help you shop affordable electronics store insurance and will even have ideas on how to bundle policies to save you money.

How Much Theft Is Covered with Electronics Store Insurance?

Theft coverage is included in your commercial property policy. If your store was robbed, you would be responsible for paying your deductible, then you would be covered up to your policy limits for the damage from the robbery. Theft insurance, however, does not cover cash or currency.

You set your deductible when you're purchasing your business insurance. If your deductible is $1,500 and you have a $10,000 property damage limit, in the event of a robbery, you would pay $1,500 and your insurance would cover all the property damage and loss related to the theft up to $10,000.

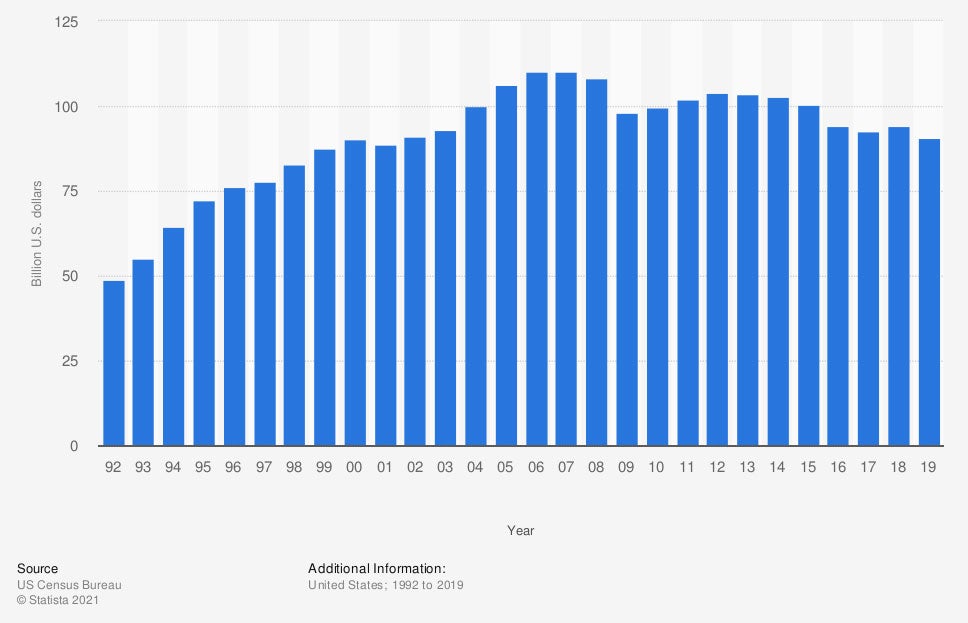

Electronics and appliance store sales in the US

Electronics and appliance store sales add up to between $90 billion and $95 billion dollars every year.

Do I Need Valuable Items Coverage?

Insurance carriers will often have exclusions in their coverage for very expensive items. In these cases, you may need to purchase valuable items coverage to receive proper protection.

"If the store carries high-end home theaters, computers, or other similar types of equipment, valuable items coverage may be appropriate," said Green.

It's best to consult with your Illinois independent insurance agent, who can tell you whether you need valuable items coverage for your store.

How an Illinois Independent Insurance Agent Can Help You

Customizing insurance is like selling electronics equipment, it's best left to the experts. An Illinois independent insurance agent understands Illinois business insurance and where to find the best rates in the state.

They'll talk with you, free of charge, about your electronics store and the protection that will be most comprehensive for your needs. They can advise you on an affordable package from a reputable carrier.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.iii.org/insurance-topics/business-insurance

https://www.statista.com/statistics/197594/annual-electronics-and-appliance-store-sales-in-the-us-since-1992/

https://www.statista.com/statistics/272116/ce-industry-growth-us/