Working for yourself can be an extremely rewarding experience. However, there are certain additional responsibilities you’re forced to take on when you’re self-employed. Having the right insurance protection is just one of them.

Fortunately an Illinois independent insurance agent can get you set up with all the self-employed insurance you need. They’ll also get you equipped with this coverage long before you need to file a claim. But before we jump too far ahead, here’s a closer look at this important coverage.

What Is Self-Employed Insurance?

According to insurance expert Jeffery Green, self-employed insurance generally refers to health insurance for those that are self-employed. Self-employed workers are able to deduct 100% of their health insurance premiums from their income.

Green added that if you’re self-employed and getting tax credits from marketplace insurance, you can also deduct the balance of what you pay. An Illinois independent insurance agent can provide you with more information about self-employed insurance.

What Does Self-Employed Insurance Cover in Illinois?

Self-employed insurance provides critical protection for workers who are not employed by another company. Green said that self-employed insurance typically covers the following:

- Hospital bills

- Medical bills

- Various routine treatments

You’ll need to double-check your specific policy to be certain of what it covers. Health insurance plans vary widely in their coverages and exclusions. Your Illinois independent insurance agent can help you find the plan that works best for you.

Self-Employed Stats for Illinois

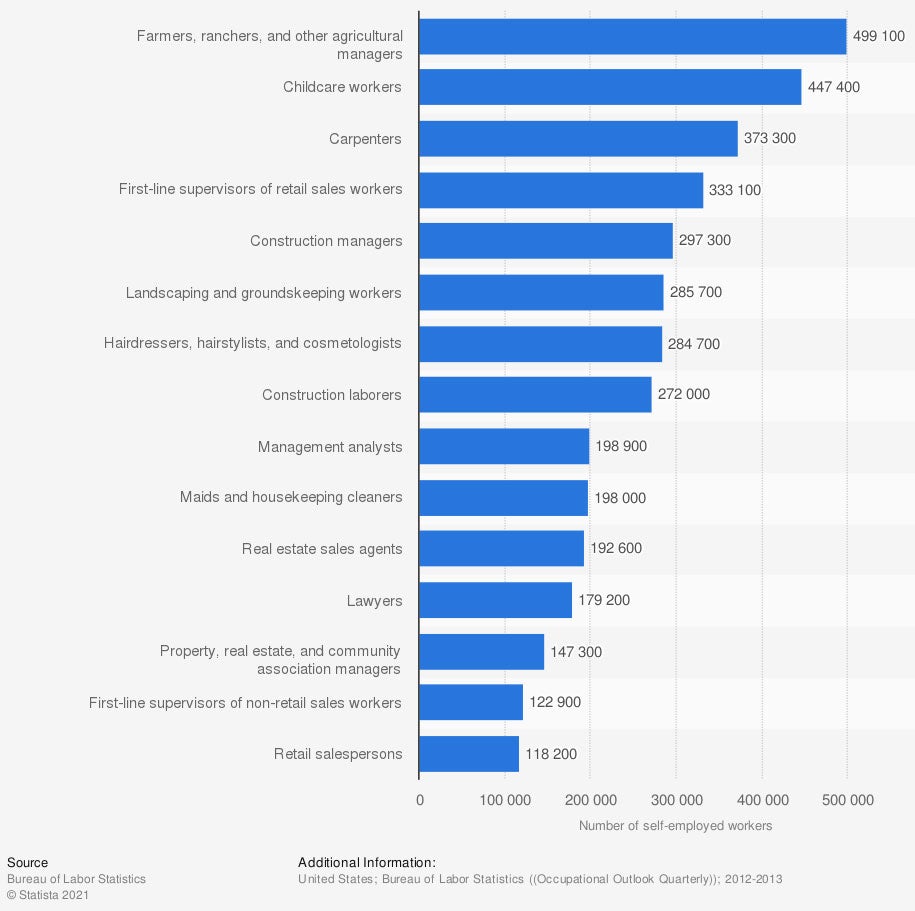

You might be curious about which industries have the highest rate of self-employed workers. Check out these stats, not for just Illinois, but for the US overall and see for yourself.

Projection of the occupations with the most self-employed workers in the US for 2022

It’s projected that farmers, ranchers, and other agricultural workers will make up the vast majority of the self-employed market in 2022, at 499,100 employees. Childcare workers (447,400) and carpenters (373,300) are projected to be the next highest.

Clearly there are hundreds of thousands of self-employed workers in many different industries across the US, which is what makes the availability of self-employed insurance so critical.

What Doesn’t Self-Employed Insurance Cover in Illinois?

To find out what your self-employed insurance excludes, you’ll need to review your specific policy with the help of your Illinois independent insurance agent. There are many types of health insurance plans available for self-employed workers, and all of them vary in their coverages and exclusions. You’ll want to shop for a self-employed health insurance policy that provides the coverage you need from the very beginning.

Disability Insurance for Being Self-Employed

Green said that individual disability is based on occupation. A self-employed roofer would be offered different coverage than a self-employed lawyer. He added that the underwriting of policies for self-employed individual disability insurance is more complex and extensive than for traditional employees.

Disability insurance companies may require self-employed workers to provide tax returns and proof of their self-employment for the last two years, or even more. An Illinois independent insurance agent can help you provide all the documentation you need to get the right self-employed disability insurance.

Do Self-Employed Workers Need Workers’ Compensation in Illinois?

In certain states and for specific occupations, yes, workers’ comp might be required for self-employed workers. One common example is self-employed contractors, who may be asked by their customers for proof of workers’ comp coverage up front. Workers’ comp coverage can be important because some health insurance plans exclude work-related injuries.

If you’re self-employed and covered by your spouse’s health insurance plan, you might need to rely on workers’ comp coverage for your own job-related injuries and illnesses. An Illinois independent insurance agent can help you find out what exactly is covered by your current health insurance.

Self-Employed Health Insurance Cost

The cost of your self-employed health insurance will vary based on numerous factors. Health insurance plans for self-employed workers are often priced by considering the following:

- Your age

- Your current health

- Your occupation

- Your specific location

- Your lifestyle (e.g., smoker or non-smoker)

Health insurance costs for self-employed workers can range from $200 per month to $500 or even more. Your Illinois independent insurance agent can help you browse affordable self-employed health insurance options.

Here’s How an Illinois Independent Insurance Agent Can Help

When it comes to protecting self-employed workers against healthcare costs and other financial stresses, no one’s better equipped to help than an independent insurance agent. Illinois independent insurance agents search through multiple carriers to find providers who specialize in every type of self-employed health insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

stats - https://www.statista.com/statistics/207331/forecast-of-the-number-of-self-employed-us-workers-by-occupation/

https://www.iii.org/article/can-i-deduct-my-health-insurance-premiums-my-income-tax-return

https://www.irmi.com/articles/expert-commentary/the-workers-compensation-self-insurance-decision

© 2025, Consumer Agent Portal, LLC. All rights reserved.