Software companies have several unique liabilities that need to be considered from the very start. Without the right protection, your company could get hit with an ugly lawsuit or be forced to shut down.

Fortunately an Illinois independent insurance agent can get you set up with the right type of software company insurance for you. They’ll even get you covered long before you need to file a claim. But before we get too far ahead of ourselves, here’s a deep dive into this crucial coverage.

What Is Software Company Insurance?

Software company insurance is a specific type of Illinois business insurance designed to meet the needs of software companies and their owners. Software companies need the basics of a business insurance package, but they also have unique risks and liabilities that require extra coverages.

Beyond just property insurance and liability protection, software companies need to consider their specific operations. Cyber liability and electronic data liability are just a couple of coverages often required by software companies.

How to Insure a Software Company in Illinois

Working together with an Illinois independent insurance agent is the best way to get your software company fully covered by all the protections it needs. Your policy might look a bit different from the software company across town’s.

Consider each aspect of your software company and the unique exposures that come along with every one of them. You’ll want to make sure your property, equipment, team, and operations are all protected against numerous disasters.

What Does Software Company Insurance Cover?

Software company insurance policies aren’t standard, so your coverages may vary a bit from the list provided below. However, there are many basic protections usually needed by software companies, according to insurance expert Jeffery Green. These include:

- Cyber liability insurance: Protects your company from data breaches and attacks by cyber criminals and the resulting lawsuits.

- Electronic data liability: Protects your company from liabilities following electronic data incidents that result in a loss of data.

- Electronic data processing: Protects your company from various disasters your equipment is susceptible to, including mechanical breakdowns, temperature and humidity changes, and electrical injuries.

- Professional liability: Protects your company against third-party lawsuits stemming from claims of harm caused by your business’s operations or services.

An Illinois independent insurance agent can help your software company get set up with all the coverage it needs to maintain smooth operations.

How Profitable Are Software Companies?

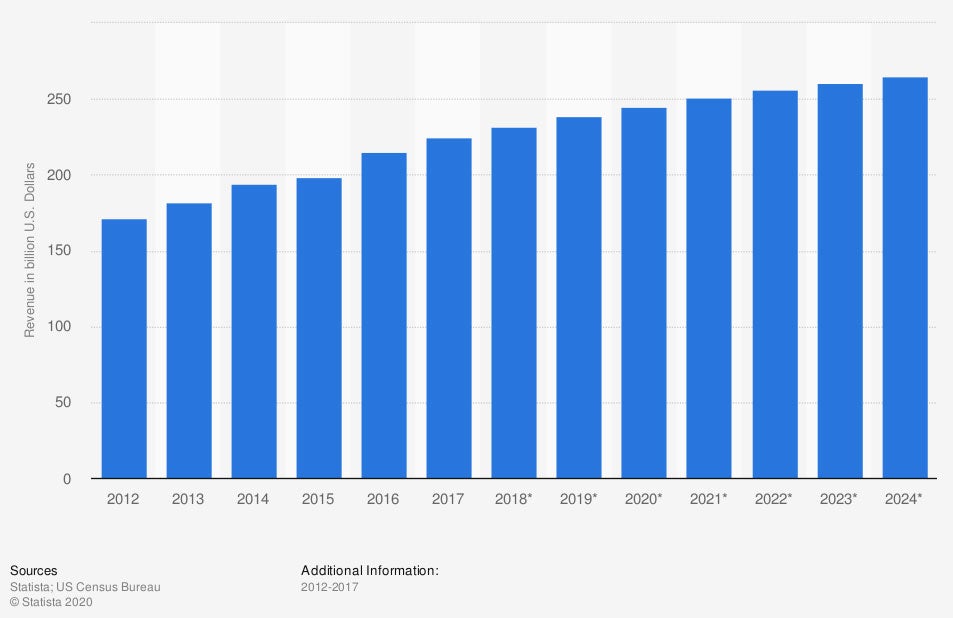

When considering coverage for your software company, it’s helpful to consider how the industry overall is performing. Check out some stats for the software publisher industry in the US below.

Industry revenue of “software publishers” in the US

Software companies are becoming more profitable as the years go by. At the beginning of the observed period, software publishers generated $171.08 billion annually. It is estimated that in the next few years, this number will reach $264.81 billion.

With software companies generating more revenue over time, it’s extra important to make sure yours is equipped with all the coverage it needs to stay operational for years to come.

What Doesn’t Software Company Insurance Cover in Illinois?

Unfortunately software company insurance doesn’t cover just anything. According to insurance expert Paul Martin, standard excluded perils under software company insurance are:

- Intentional and malicious acts

- Employee dishonesty

- Regulatory/statutory penalties

- Nuclear fallout or war damage

Since software company insurance isn’t standard. It’s important to review your specific policy’s exclusions with the help of your Illinois independent insurance agent.

How Much Does Software Company Insurance Cost in Illinois?

As with any other type of insurance, the cost of your software company policy typically depends on several factors. Martin said these factors often include:

- The specific operations of your software company

- Your software company’s location

- The size of your software company

- Your software company’s annual revenue

Software companies in larger cities like Chicago might pay quite a bit more for their coverage than those located in smaller towns. Also, companies in areas with greater risk of storm damage are likely to pay higher premiums. Your Illinois independent insurance agent can provide quotes for software company insurance in your town.

Here’s How an Illinois Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect software companies against commonly faced liabilities. Illinois independent insurance agents shop multiple carriers to find providers who specialize in software company insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.statista.com/forecasts/311146/software-publishers-revenue-in-the-us

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/internet-businesses

https://www.irmi.com/term/insurance-definitions/data-processing-coverage#:~:text=Data%20Processing%20Coverage%20%E2%80%94%20all%20risks,changes%20in%20temperature%20and%20humidity.

© 2025, Consumer Agent Portal, LLC. All rights reserved.